Small Business Accounting Courses

Small Business Accounting Courses - We’ve chosen 10 of the best accounting courses from the top training providers to help you find the perfect fit. Accounting is important for small businesses because you can gain insight into your company's finances and forecasting with accurate data. Increase your productivity and achieve business success. Accounting involves recording, classifying, reporting, and summarizing financial transactions. Internal revenue service rules for tax reporting can differ from gaap, cash basis accounting, and ifrs. For small business owners, understanding accounting is crucial to managing cash flow, reducing errors, and planning for growth. Small business accounting classes can be one of the best ways for small business owners to learn accounting skills for their businesses quickly. Discover the best online accounting courses to learn accounting, finance, bookkeeping, and improve your job skills. Whether you’re a small business owner, someone launching a bookkeeping business, or just want to better understand your company’s financial data, these courses offer flexible and practical knowledge. Or let you forecast financial trends. Keeping a busy schedule in mind, each of these free online courses for small business owners will allow you to level up your business management skills at your own pace and without worrying about making a big investment. We’ve rounded up 20 of our best small business courses in the areas of finance, productivity, project management, sales and customer service, soft skills, and business tools. Enroll with ed2go today and take small business courses near you in chicago. The certificate program consists of 15 credit hours in accounting; Sba offers online training programs, and development and growth opportunities designed to empower and educate small business owners. Topics include essential management skills and how to prepare a business plan and marketing strategies. We’ve chosen 10 of the best accounting courses from the top training providers to help you find the perfect fit. Discover the best online accounting courses to learn accounting, finance, bookkeeping, and improve your job skills. Whether you’re a small business owner, someone launching a bookkeeping business, or just want to better understand your company’s financial data, these courses offer flexible and practical knowledge. Explore common us tax forms and tax filing options. Whether you're a complete beginner or looking to brush up on specific accounting concepts, there's an online course that’s perfect for you. Accounting is important for small businesses because you can gain insight into your company's finances and forecasting with accurate data. Understanding tax accounting standards is essential for taking advantage of small business deductions and submitting accurate forms. Small. Whether you're a complete beginner or looking to brush up on specific accounting concepts, there's an online course that’s perfect for you. A course on how to start and operate a small business. We’ve rounded up 20 of our best small business courses in the areas of finance, productivity, project management, sales and customer service, soft skills, and business tools.. Consider the section 179 deduction. Or let you forecast financial trends. You may be able to deduct the equipment cost from your taxes immediately. Discuss the corporate entities relevant to small businesses. Enroll with ed2go today and take small business courses near you in chicago. There is a multitude of small business accounting classes that can help improve an owner’s knowledge of accounting. We’ve chosen 10 of the best accounting courses from the top training providers to help you find the perfect fit. Here are the top 10 online accounting courses available to small business owners today: You may be able to deduct the equipment. Dig deeper into costs of goods sold, and how to identify expenses. Read this guide to discover financial reporting and the different accounting systems, accounting software, and whether you can do your own small business accounting. Explore common us tax forms and tax filing options. Because a simple online accounting course can equip you with skills to create more professional. Sba offers online training programs, and development and growth opportunities designed to empower and educate small business owners. The certificate program consists of 15 credit hours in accounting; A course on how to start and operate a small business. As a small business owner, the thought of an audit can be daunting. Small business owners should master the art of. There are a plethora of online bookkeeping courses that can equip you with bookkeeping knowledge to help you gain control of your cash flow and grow your business. This guide will take you through essential accounting principles—from daily bookkeeping to financial statement analysis—so you can confidently manage your business finances and avoid common pitfalls. Enroll in business accounting classes to. Keeping a busy schedule in mind, each of these free online courses for small business owners will allow you to level up your business management skills at your own pace and without worrying about making a big investment. Small business owners should master the art of accounting. Small business accounting classes can be one of the best ways for small. Introduce income statements, balance sheets, and statements of cash flows, and explain their importance. Accounting is important for small businesses because you can gain insight into your company's finances and forecasting with accurate data. The certificate program consists of 15 credit hours in accounting; This guide will take you through essential accounting principles—from daily bookkeeping to financial statement analysis—so you. Discuss the corporate entities relevant to small businesses. Introduce income statements, balance sheets, and statements of cash flows, and explain their importance. Sba offers online training programs, and development and growth opportunities designed to empower and educate small business owners. Small business accounting classes can be one of the best ways for small business owners to learn accounting skills for. There is a multitude of small business accounting classes that can help improve an owner’s knowledge of accounting. You may be able to deduct the equipment cost from your taxes immediately. For small business owners, understanding accounting is crucial to managing cash flow, reducing errors, and planning for growth. Or let you forecast financial trends. Dig deeper into costs of goods sold, and how to identify expenses. A background in finance and accounting allows graduates to work in. Learn how to correctly and efficiently do your small business's accounting by taking the best courses online. Discuss the corporate entities relevant to small businesses. Introduce income statements, balance sheets, and statements of cash flows, and explain their importance. The certificate is open to individuals who possess either 1) an undergraduate degree with a minimum cumulative gpa of 2.33 or 2) a master’s level (or above) degree. Internal revenue service rules for tax reporting can differ from gaap, cash basis accounting, and ifrs. Whether you’re a small business owner, someone launching a bookkeeping business, or just want to better understand your company’s financial data, these courses offer flexible and practical knowledge. Taking the right courses in business school. A course on how to start and operate a small business. These recommendations are part of goskills’ extensive collection of online business courses for teams and business courses for learners. The certificate program consists of 15 credit hours in accounting;Free Online Bookkeeping Course Bookkeeping course, Online bookkeeping

Accounting Programs for Small Business Streamline Your Small Business

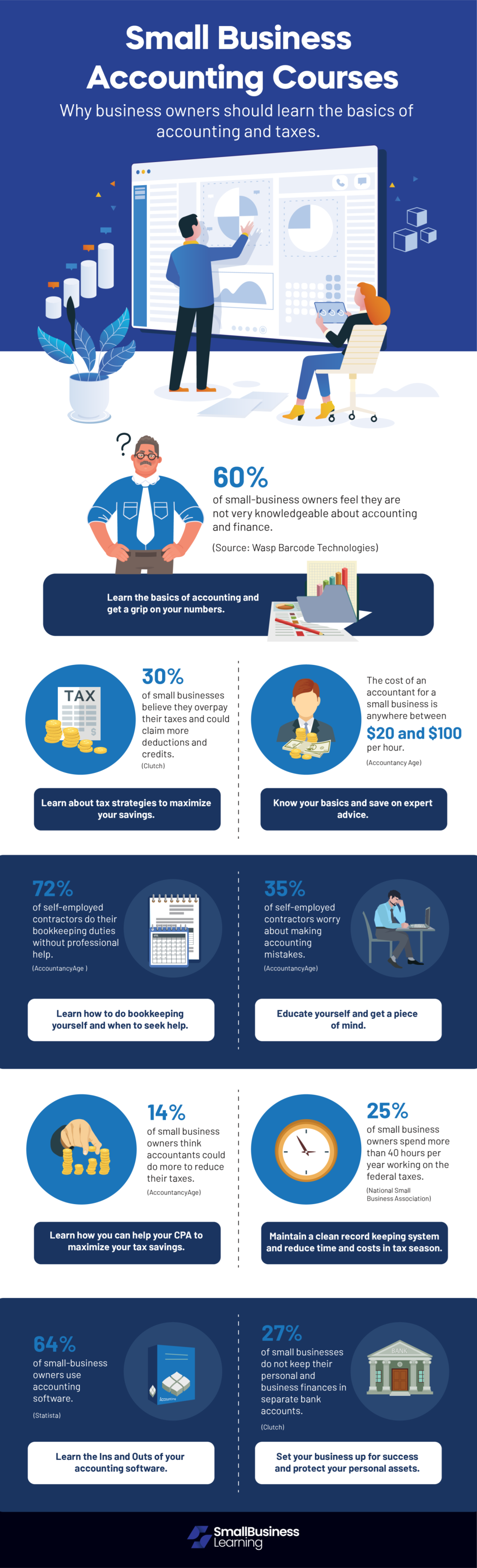

Small Business Accounting Courses Infographics Zone Submit Infographics

10 Free Bookkeeping Courses to Understand Business Accounts

Bookkeeping basics for small business. Learn accounting step by step

Diploma in Small Business Accounting Online Certification Courses

50 Free Accounting Courses and Classes for Small Business Owners

Small Business Accounting And Bookkeeping Training Program

Basic accounting for small business Sat Business Academy

Small Business Accounting Courses Infographics Zone Submit Infographics

Explore Common Us Tax Forms And Tax Filing Options.

Accounting Involves Recording, Classifying, Reporting, And Summarizing Financial Transactions.

Accounting Is Important For Small Businesses Because You Can Gain Insight Into Your Company's Finances And Forecasting With Accurate Data.

Enroll With Ed2Go Today And Take Small Business Courses Near You In Chicago.

Related Post: