Real Estate Tax Course

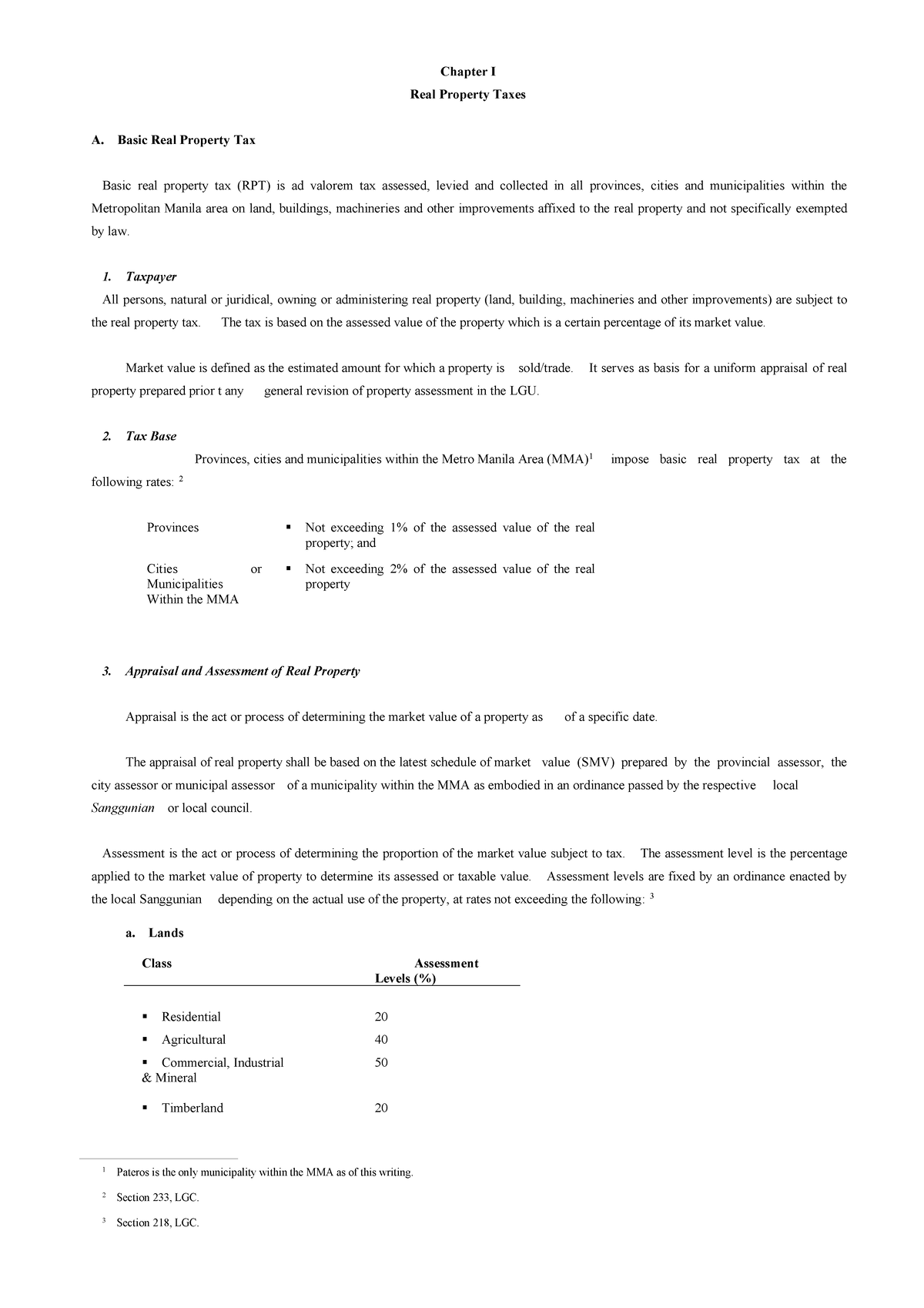

Real Estate Tax Course - Comprehensive exam proving preparer's knowledge to receive credential. [london] a nascent recovery in europe’s real estate market has been derailed by global economic uncertainty in the early months of us president donald trump’s second term,. Understand the complex rules of depreciation, bonus depreciation, and section 179; Discover innovative tax strategies that most investors and cpas overlook. We will discuss in detail the. Consider attending workshops or webinars focused on taxes for real estate agents. The illinois department of revenue’s education program. For businesses that deal in real estate, navigating the tax landscape is a critical component of maximizing profitability and ensuring compliance. Notes you will receive an email confirmation with the course link and details. 20+ irs ce credit hours. [london] a nascent recovery in europe’s real estate market has been derailed by global economic uncertainty in the early months of us president donald trump’s second term,. Join 10,000 others and stay up to date with classes and insights from the u of i tax school. Basic working knowledge of real estate taxation. Foundational courses drawn from across stern’s departments address real estate primary markets, real. Up to 10% cash back in this comprehensive course, you will learn how to: Discover innovative tax strategies that most investors and cpas overlook. The duration of real estate education can vary significantly depending on your chosen path. Learn how the irc taxes rental operations; In the real estate tax guide, we address the essential elements of the tax code as they pertain to real estate, to give users a grounding in the issues that can impact their operational. 20+ irs ce credit hours. Navigate the intricate landscape of real estate taxation with precision and strategic insight in this comprehensive course tailored for accountants. 20+ irs ce credit hours. Consider attending workshops or webinars focused on taxes for real estate agents. The economic, legal, tax, and regulatory environments of real estate investment. Below you can find links to information about idor’s education program, office. Understand the complex rules of depreciation, bonus depreciation, and section 179; Each listing includes the course number,. Foundational courses drawn from across stern’s departments address real estate primary markets, real. Identify and claim the most lucrative real estate tax deductions, such as mortgage interest, property taxes, and. Tax laws are constantly changing, so staying informed is crucial. With this comprehensive real estate taxation guide, real estate professionals will be better equipped to optimize their tax strategies, navigate complex transactions with ease, and. Learn via online courses, webinars, or classrooms. Learn the rules of real estate development; Comprehensive exam proving preparer's knowledge to receive credential. Following is a list of courses approved by the department grouped alphabetically by. Foundational courses drawn from across stern’s departments address real estate primary markets, real. Consider attending workshops or webinars focused on taxes for real estate agents. Federal tax education from the university of illinois tax school is affordable, high quality, and. The key to real estate taxes: Learn how the irc taxes rental operations; The key to real estate taxes: Discover innovative tax strategies that most investors and cpas overlook. Basic working knowledge of real estate taxation. Join 10,000 others and stay up to date with classes and insights from the u of i tax school. Navigate the intricate landscape of real estate taxation with precision and strategic insight in this comprehensive course tailored. 20+ irs ce hours of education. Navigate the intricate landscape of real estate taxation with precision and strategic insight in this comprehensive course tailored for accountants. Below you can find links to information about idor’s education program, office qualifications, and the department’s course schedule. Navigate the intricate landscape of real estate taxation with precision and strategic insight in this comprehensive. For businesses that deal in real estate, navigating the tax landscape is a critical component of maximizing profitability and ensuring compliance. Navigate the intricate landscape of real estate taxation with precision and strategic insight in this comprehensive course tailored for accountants. Tax laws are constantly changing, so staying informed is crucial. 7 beds, 2 baths ∙ 7523 s kimbark ave,. We will discuss in detail the. Tax laws are constantly changing, so staying informed is crucial. 20+ irs ce credit hours. Consider attending workshops or webinars focused on taxes for real estate agents. In the real estate tax guide, we address the essential elements of the tax code as they pertain to real estate, to give users a grounding in. In the real estate tax guide, we address the essential elements of the tax code as they pertain to real estate, to give users a grounding in the issues that can impact their operational. Navigate the intricate landscape of real estate taxation with precision and strategic insight in this comprehensive course tailored for accountants. Below you can find links to. The economic, legal, tax, and regulatory environments of real estate investment. 20+ irs ce hours of education. Join 10,000 others and stay up to date with classes and insights from the u of i tax school. The key to real estate taxes: Comprehensive exam proving preparer's knowledge to receive. In this cpe course, speaker jackie meyer explores strategic tax. Basic working knowledge of real estate taxation. Identify and claim the most lucrative real estate tax deductions, such as mortgage interest, property taxes, and. Learn the rules of real estate development; Foundational courses drawn from across stern’s departments address real estate primary markets, real. Understand when a taxpayer can take advantage of the. You will deepen your understanding of the complex. In the real estate tax guide, we address the essential elements of the tax code as they pertain to real estate, to give users a grounding in the issues that can impact their operational. [london] a nascent recovery in europe’s real estate market has been derailed by global economic uncertainty in the early months of us president donald trump’s second term,. Notes you will receive an email confirmation with the course link and details. Federal tax education from the university of illinois tax school is affordable, high quality, and. Below you can find links to information about idor’s education program, office qualifications, and the department’s course schedule. Understand the complex rules of depreciation, bonus depreciation, and section 179; Comprehensive exam proving preparer's knowledge to receive credential. We will discuss in detail the. Learn how to calculate gain or loss on the sale of real estate;TAXPreferentialTaxes Chapter I Real Property Taxes A. Basic Real

Taxonics on LinkedIn continuingeducation realestate

Real Estate Professional Tax Strategy YouTube

HOME

Course Material 4 Deductions From Estate Tax Payables PDF Estate

Comprehensive Tax Course 2024

Real Estate Taxes & How to Maximize Your Earnings Real estate courses

InDepth Tax Course Brochure

Free Tax Course Lecture 05 From House Property

Resources

The Economic, Legal, Tax, And Regulatory Environments Of Real Estate Investment.

Learn How The Irc Taxes Rental Operations;

Comprehensive Exam Proving Preparer's Knowledge To Receive.

Join 10,000 Others And Stay Up To Date With Classes And Insights From The U Of I Tax School.

Related Post: