How Much Does A Tax Preparer Course Cost

How Much Does A Tax Preparer Course Cost - How much does a tax preparer make? Don’t worry, they don’t actually cost $5,000. The cost to become a tax preparer varies greatly by region. According to the bureau of labor statistics a tax preparer makes a median salary of $48,250 annually ††. Understanding how much does tax preparation classes cost can help prospective tax preparers budget effectively and make informed decisions about their education. Cpa exam review course costs. Ashworth college's flexible tuition options for the online tax preparation training covers your course materials, certification exam and practice test. The cpa training center offers several tax preparer training courses, including a full inventory of ctp training courses and workshops, many with cpe. The total tuition fees for the tax courses are clearly stated on the enrollment forms. The irs charges a $19.75 fee to apply for (or renew) a ptin. How much does a tax preparer make? Tax preparers must take various state and federal exams to obtain their state certificate after which they can be licensed to file taxes. Grading is done within 24 hours. The total tuition fees for the tax courses are clearly stated on the enrollment forms. To become a ctec registered tax preparer, the california tax education council requires you to hold and maintain a $5,000 tax preparer bond. We’ve even asked our experts. Our online tax preparation training includes the cost of the national association of certified public bookkeepers (nacpb) tax certification exam, practice test, and your official certificate when. In this article, we'll cover much more than just how to get your ptin, your efin, and whether or not you need a license to prepare tax returns. According to the bureau of labor statistics a tax preparer makes a median salary of $48,250 annually ††. Apply for a preparer tax identification number (ptin) from the irs; We’ve even asked our experts. Don’t worry, they don’t actually cost $5,000. Ashworth college's flexible tuition options for the online tax preparation training covers your course materials, certification exam and practice test. To become a ctec registered tax preparer, the california tax education council requires you to hold and maintain a $5,000 tax preparer bond. Grow your careeronline programsmall class. Our online tax preparation training includes the cost of the national association of certified public bookkeepers (nacpb) tax certification exam, practice test, and your official certificate when. Understanding how much does tax preparation classes cost can help prospective tax preparers budget effectively and make informed decisions about their education. Permanent employees, h&r block says, are eligible for paid benefits. Continue. Will this online tax preparation. While house price growth is expected to slow further, towards 1 to 1.5%, we're still on course for a 5% uplift in sales volumes in 2025, assuming sellers remain pragmatic on. The irs charges a $19.75 fee to apply for (or renew) a ptin. How much does a tax preparer make? We’ve even asked our. How do i know the total cost of the tax preparation class. Once i complete the course how long before the irs (or ctec) is notified of my hours? Grading is done within 24 hours. In this article, we'll cover much more than just how to get your ptin, your efin, and whether or not you need a license to. Cpa exam review course costs. While house price growth is expected to slow further, towards 1 to 1.5%, we're still on course for a 5% uplift in sales volumes in 2025, assuming sellers remain pragmatic on. Apply for a preparer tax identification number (ptin) from the irs; Will this online tax preparation. Our online tax preparation training includes the cost. How do i know the total cost of the tax preparation class. Once i complete the course how long before the irs (or ctec) is notified of my hours? The irs charges a $19.75 fee to apply for (or renew) a ptin. Continue your education and stay up to date. Complete our comprehensive tax course; Will this online tax preparation. View our full tuition and payment options here. The cost to become a tax preparer varies greatly by region. While house price growth is expected to slow further, towards 1 to 1.5%, we're still on course for a 5% uplift in sales volumes in 2025, assuming sellers remain pragmatic on. Penn foster offers an affordable. Our online tax preparation training includes the cost of the national association of certified public bookkeepers (nacpb) tax certification exam, practice test, and your official certificate when. Passing the cpa exam without a solid cpa exam review course is extremely rare. Once i complete the course how long before the irs (or ctec) is notified of my hours? To become. View our full tuition and payment options here. Grading is done within 24 hours. Passing the cpa exam without a solid cpa exam review course is extremely rare. Will this online tax preparation. Continue your education and stay up to date. Permanent employees, h&r block says, are eligible for paid benefits. In this article, we'll cover much more than just how to get your ptin, your efin, and whether or not you need a license to prepare tax returns. Cpa exam review course costs. Passing the cpa exam without a solid cpa exam review course is extremely rare. Don’t worry, they. Will this online tax preparation. According to payscale, tax preparers working for h&r block average about $13.60 per hour. We’ve even asked our experts. Passing the cpa exam without a solid cpa exam review course is extremely rare. The cpa training center offers several tax preparer training courses, including a full inventory of ctp training courses and workshops, many with cpe. While house price growth is expected to slow further, towards 1 to 1.5%, we're still on course for a 5% uplift in sales volumes in 2025, assuming sellers remain pragmatic on. The irs charges a $19.75 fee to apply for (or renew) a ptin. To become a ctec registered tax preparer, the california tax education council requires you to hold and maintain a $5,000 tax preparer bond. In this article, we'll cover much more than just how to get your ptin, your efin, and whether or not you need a license to prepare tax returns. And how do i pay for it? Once i complete the course how long before the irs (or ctec) is notified of my hours? Complete our comprehensive tax course; Cpa exam review course costs. Grow your careeronline programsmall class sizes100% online Tax preparers must take various state and federal exams to obtain their state certificate after which they can be licensed to file taxes. Become a certified tax preparer.Understand Tax Preparer Course Costs Invest in Your Career

How Much Does a Tax Preparer Course Cost? Why Universal Accounting

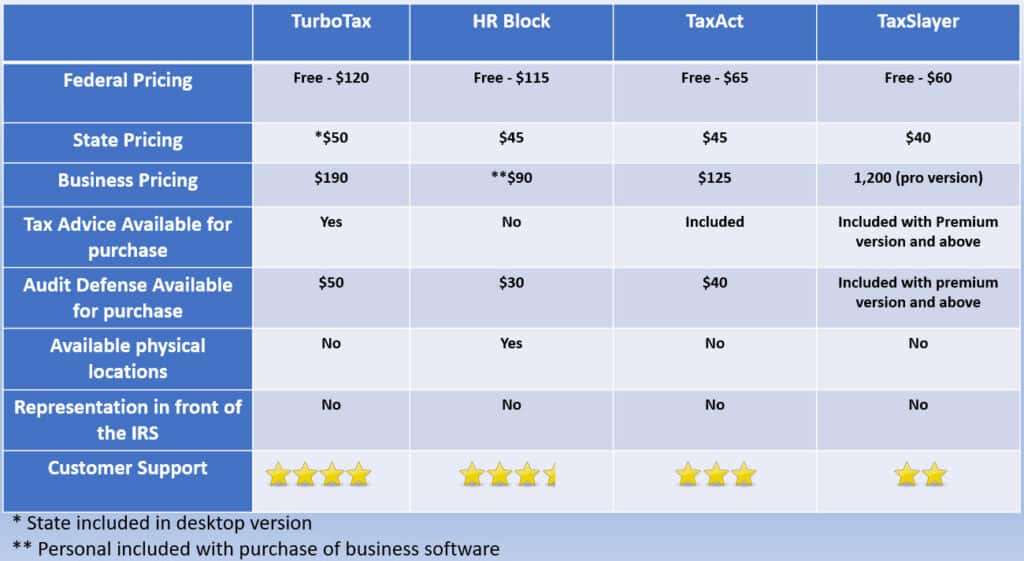

Tax Preparation Fees 2024 Pen Kathie

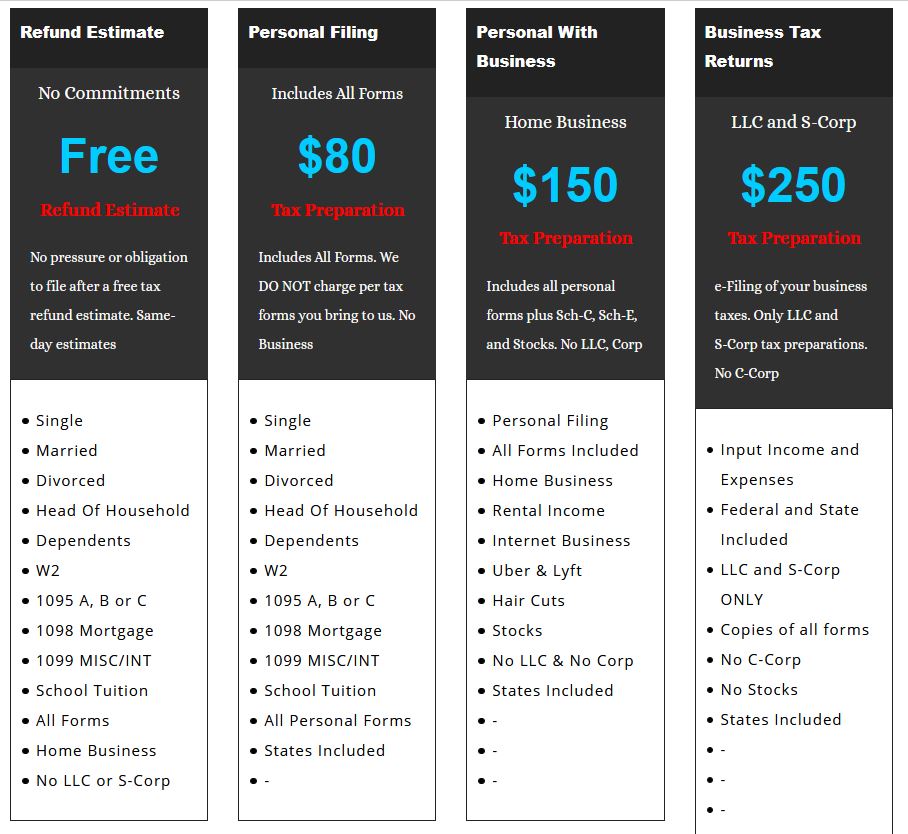

Tax Preparation Pricing Options ARA Government Services, LLC

NSA Survey Reveals Fee and Expense Data For Tax Accounting Firms in

Average Cost of Tax Preparation by CPA Business and Personal Tax

How Much Does a Tax Preparer Course Cost? Why Universal Accounting

How Much Does Tax Preparation Cost?

Tax Preparation Fees and Pricing at 80 TaxRecover

Tax Preparation Fees 2024 Pen Kathie

Grading Is Done Within 24 Hours.

Ashworth College's Flexible Tuition Options For The Online Tax Preparation Training Covers Your Course Materials, Certification Exam And Practice Test.

Continue Your Education And Stay Up To Date.

Don’t Worry, They Don’t Actually Cost $5,000.

Related Post:

/tax-preparation-prices-and-fees-3193048_color2-HL-8b4b5382e1a44aa0864ed504d4ca5414.gif)