Financial Due Diligence Course

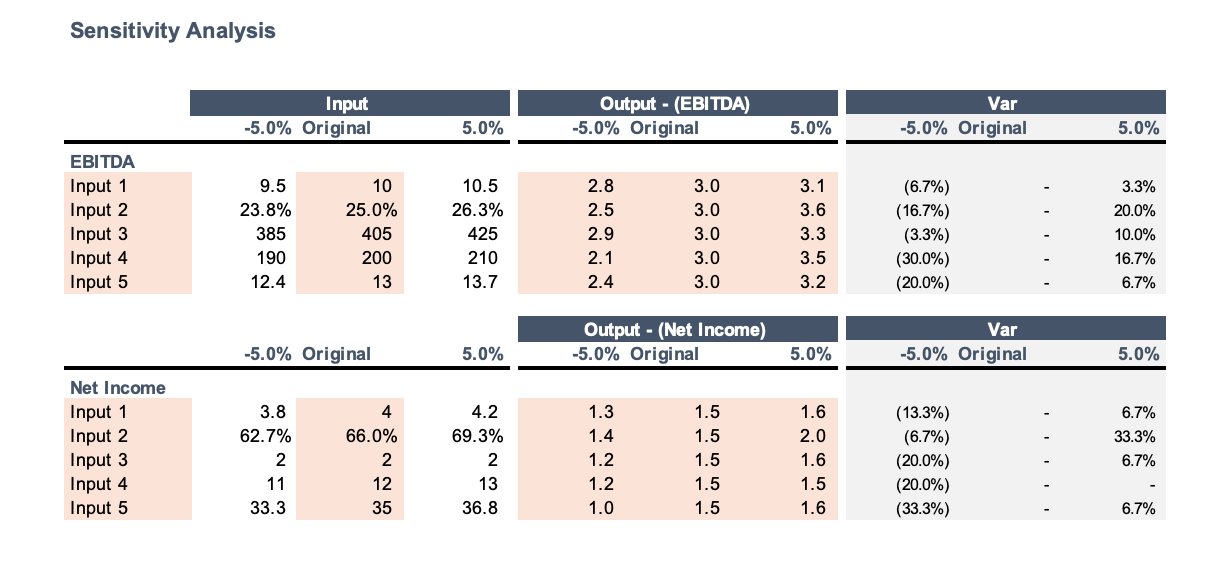

Financial Due Diligence Course - This process helps uncover critical insights by addressing key questions, such as whether the financial information is accurate and truly reflects business performance or if there are hidden red. Consider an online finance course or contact us for assistance. Explore how to best manage internal and external due diligence resources. Financial due diligence (fdd) is the cornerstone of mergers and acquisitions (m&as), allowing buyers to assess a company’s financial health, uncover potential risks, and make informed decisions. In this course, you will create a due diligence project plan for your investment or opportunity that maps out how to get from term sheet to closing. Most of these courses aim to provide a general overview of the due diligence process rather than delving into the specifics of a particular area. A ddq, or a due diligence questionnaire, is just what it sounds like. Learn financial due diligence through our due diligence courses and training to be a better financial analyst, a better investor and participate in m&a, strategy or turnaround projects. In the private markets and due diligence module, you will learn the essential skills required to evaluate and execute private equity transactions. Looking to get your financial analysis skills to the next level? It incorporates comprehensive legal and compliance reviews while defining clear integration timelines and oversight mechanisms to ensure value creation. Or maybe are you already working as an auditor and want to move to a m&a transaction services role? Understand the significance of due diligence and risk analysis, covering market, credit, and. It provides vital insights well beyond the scope of a standard audit. Acquire due diligence techniques and best practices which will maximize your organization’s ability to achieve the intended goals of the acquisition. Welcome to the financial due diligence techniques training course, where you’ll learn to dive deep into financials, ask the tough questions, and uncover the key insights that determine a deal’s value. This course is designed to give you a deep dive into the process, techniques, and best practices of financial due diligence. Whether it's mergers, acquisitions, or investments, due diligence is the cornerstone of making informed financial decisions. Given the complexity and importance of due diligence, there is a growing number of due diligence courses available on the market. It involves strategically navigating different areas of the financial world. You'll also interpret kpis across various sectors. This course only includes the part 6 of the complete p&l financial due diligence course. However, as businesses grow more complex and transactions move faster, traditional fdd approaches, focused mainly on historical analysis, are proving. Additionally, the course highlights the value of consulting with internal experts to build a strong case for due. It is the company asking its potential partner to provide due diligence in terms of risk, security compliance, or capabilities. This course only includes the part 4 and 5 of the complete p&l financial due diligence course. Calculating the costs associated with the project and assessing them against the anticipated benefits to ascertain its financial feasibility. We would need to. Professional certificate in due diligence & business valuation explore tools for securities analysis, value assessment, and competitive business strategy. From engaging in venture capital ventures and embracing fintech innovations to adopting the steady approach of value investing and understanding finance and accounting basics, each step you take is a calculated move toward enhancing your. It involves strategically navigating different areas. Whether it's mergers, acquisitions, or investments, due diligence is the cornerstone of making informed financial decisions. It incorporates comprehensive legal and compliance reviews while defining clear integration timelines and oversight mechanisms to ensure value creation. You would want to do financial due diligence as an acquiring firm to. Financial due diligence (fdd) is the cornerstone of mergers and acquisitions (m&as),. Whether it's mergers, acquisitions, or investments, due diligence is the cornerstone of making informed financial decisions. Welcome to the financial due diligence techniques training course, where you’ll learn to dive deep into financials, ask the tough questions, and uncover the key insights that determine a deal’s value. In this fdd masterclass, you'll master the fdd process, learn to spot red. From engaging in venture capital ventures and embracing fintech innovations to adopting the steady approach of value investing and understanding finance and accounting basics, each step you take is a calculated move toward enhancing your. We would need to complete a ddq for. This is the only course on market today with a sole focus on the financial aspects of. It emphasizes the urgent need for compliance with key legislation to prevent potential financial losses and damage to your company's reputation. In this course, you will create a due diligence project plan for your investment or opportunity that maps out how to get from term sheet to closing. Can't find the course you need? You'll also interpret kpis across various. This course only includes the part 6 of the complete p&l financial due diligence course. This is the only course on market today with a sole focus on the financial aspects of due diligence. Our comprehensive due diligence solutions help clients minimize risks and make the most informed business decisions. The course is thorough, covering topics that one would expect. There are different types of due diligence. Delving into the project’s financial health, including reviewing financial statements, assessing revenue projections, and analyzing cash flow. We would need to complete a ddq for. Trainup.com currently lists virtual finance courses and training in and nearby the chicago region from 5 of the industry's leading training providers, such as kaplan financial, american management. This course is designed to give you a deep dive into the process, techniques, and best practices of financial due diligence. There are different types of due diligence. Changes in accounting policies or practices. It is the company asking its potential partner to provide due diligence in terms of risk, security compliance, or capabilities. You would want to do financial. Changes in accounting policies or practices. In this course, you will create a due diligence project plan for your investment or opportunity that maps out how to get from term sheet to closing. There are different types of due diligence. Welcome to the financial due diligence techniques training course, where you’ll learn to dive deep into financials, ask the tough questions, and uncover the key insights that determine a deal’s value. Out of period items / reserve reversals. This is the only course on market today with a sole focus on the financial aspects of due diligence. Additionally, the course highlights the value of consulting with internal experts to build a strong case for due diligence, ensuring that your business operations remain robust and legally sound. It involves strategically navigating different areas of the financial world. We cover everything from analyzing financial statements to identifying operational risks, tax implications, and potential fraud. Financial due diligence (fdd) is vital to. The course is thorough, covering topics that one would expect such as financial, legal, and tax due diligence. Learn financial due diligence to be a better financial analyst, a better investor and participate in m&a, strategy or turnaround projects. Delving into the project’s financial health, including reviewing financial statements, assessing revenue projections, and analyzing cash flow. Or maybe are you already working as an auditor and want to move to a m&a transaction services role? You would want to do financial due diligence as an acquiring firm to. In the private markets and due diligence module, you will learn the essential skills required to evaluate and execute private equity transactions.Financial Due Diligence Course P&L Eloquens

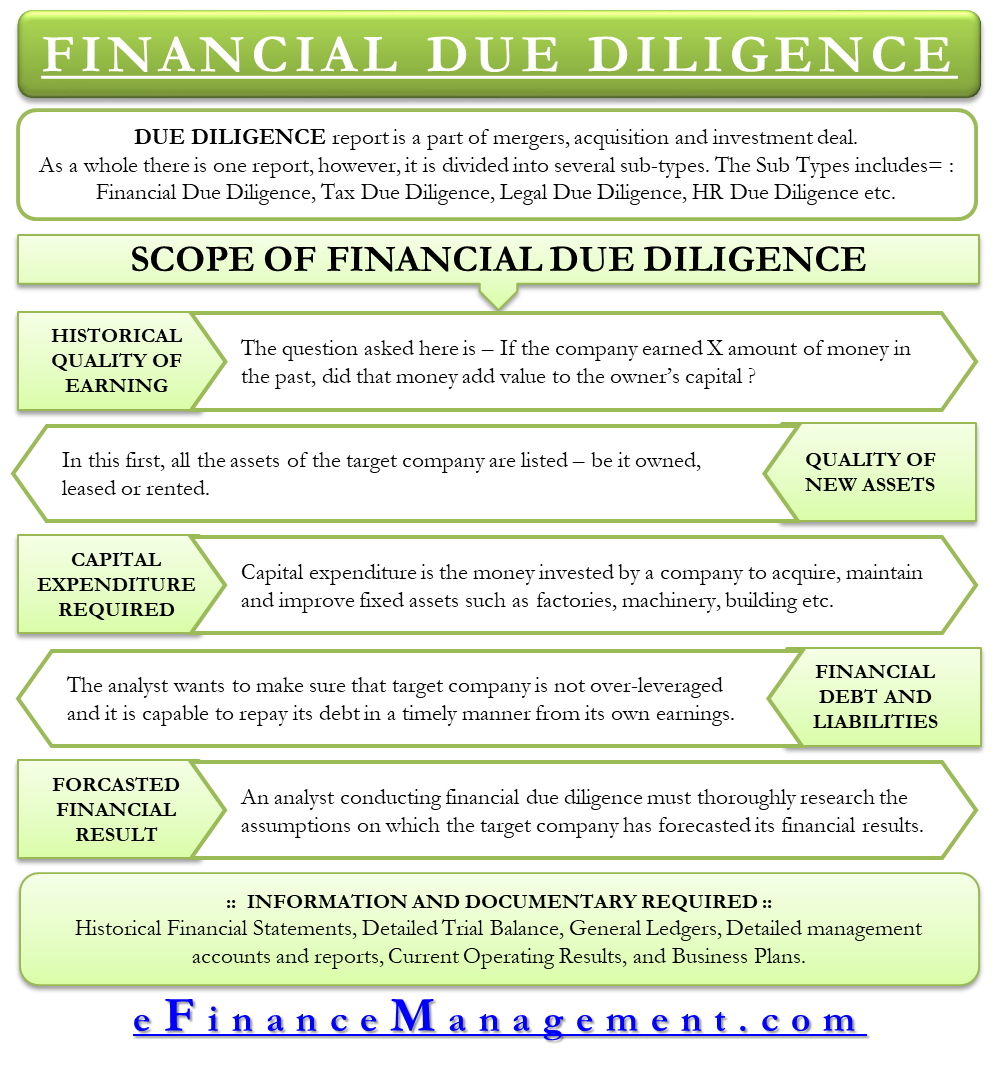

Financial Due Diligence Importance, Scope and Requirements eFM

Financial DueDiligence Course 16.05.2023 PDF

Financial Due Diligence Course P&L Eloquens

Financial Due Diligence Course P&L Eloquens

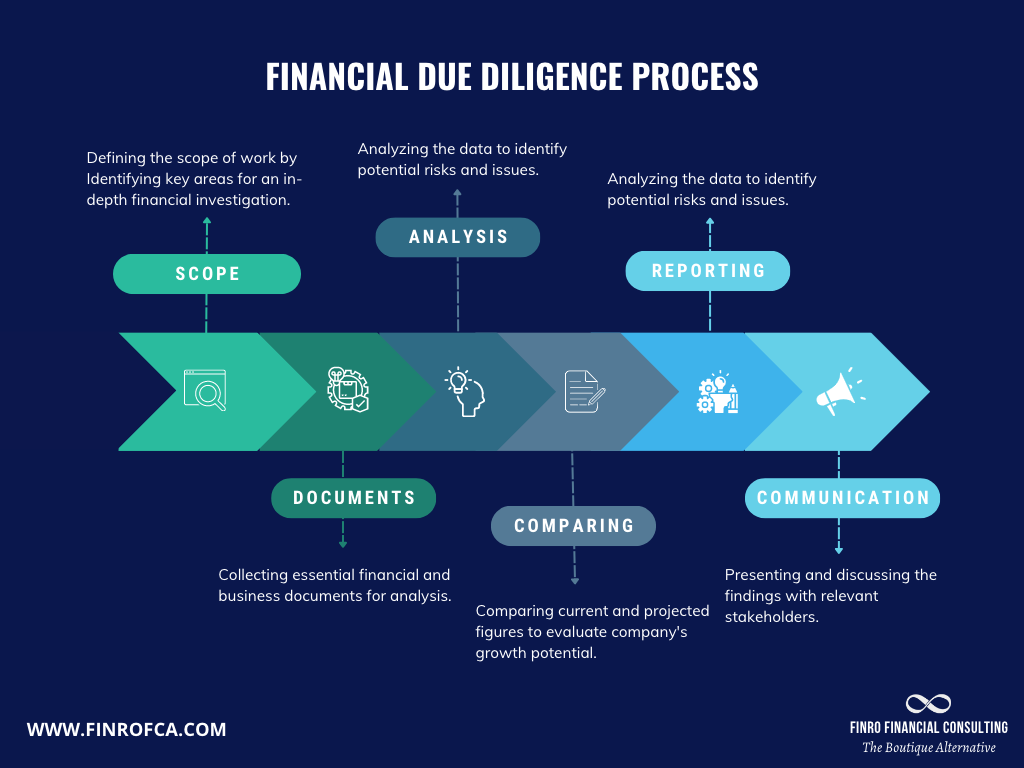

What is Financial Due Diligence, and Why is it Important? Finro

Ensuring Investment Success Comprehensive Due Diligence Strategies for

Financial Due Diligence A Methodology Note Asian Development Bank

Financial due diligence guideline ICAEW

Financial Due Diligence Presentation Template

This Process Helps Uncover Critical Insights By Addressing Key Questions, Such As Whether The Financial Information Is Accurate And Truly Reflects Business Performance Or If There Are Hidden Red.

Calculating The Costs Associated With The Project And Assessing Them Against The Anticipated Benefits To Ascertain Its Financial Feasibility.

Trainup.com Currently Lists Virtual Finance Courses And Training In And Nearby The Chicago Region From 5 Of The Industry's Leading Training Providers, Such As Kaplan Financial, American Management Association International, And New Horizons.

This Process Includes Key Milestones, Timeframes, A Detailed Understanding Of Key Players' Responsibilities, And Consideration For The Various Types Of Due Diligence.

Related Post: