Example Of Holder In Due Course

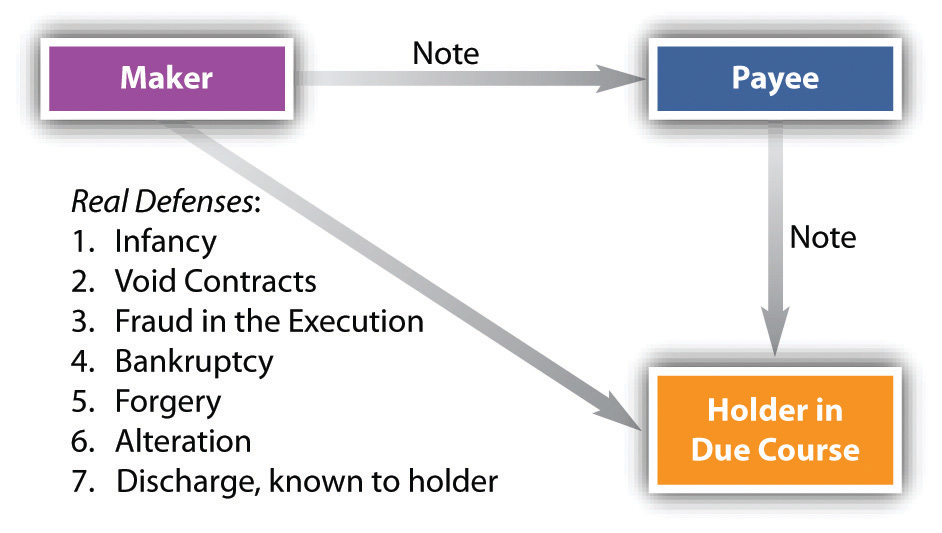

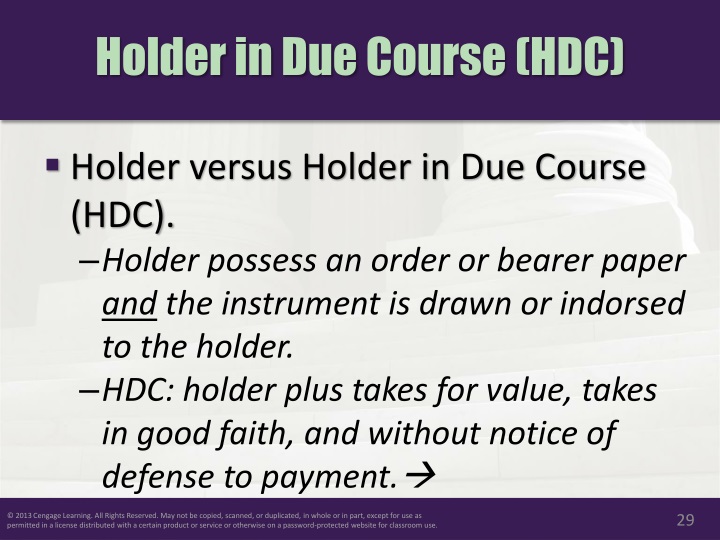

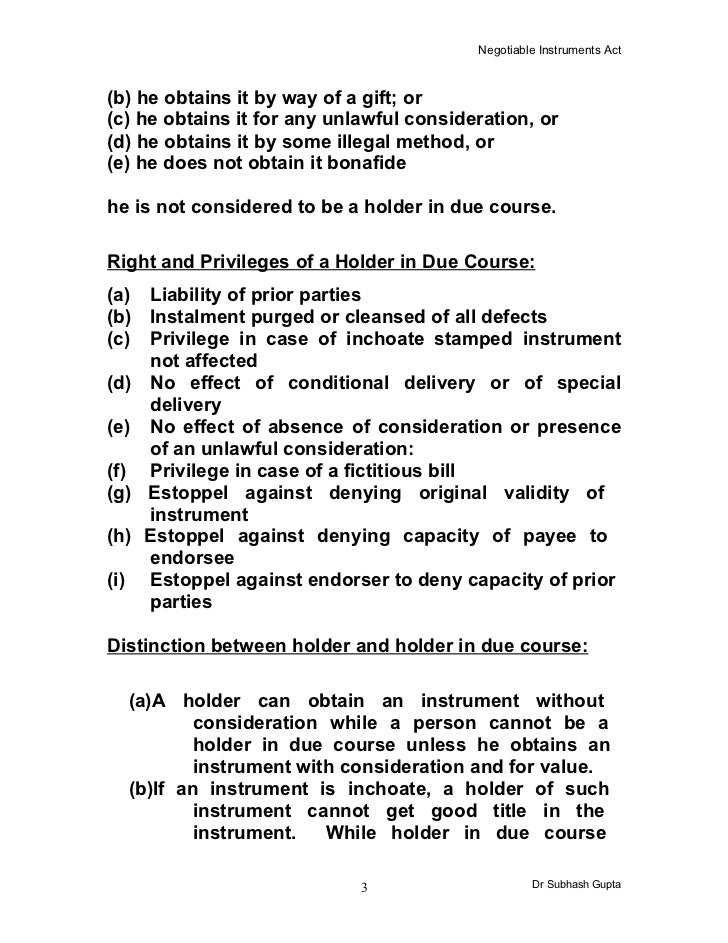

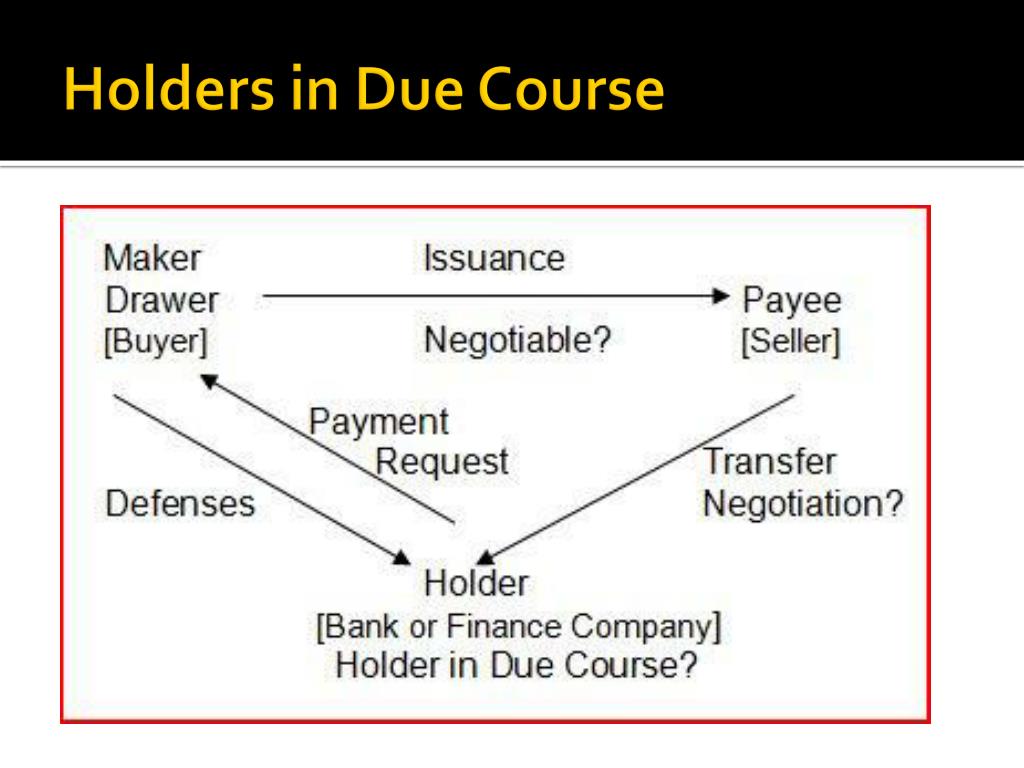

Example Of Holder In Due Course - The rights of a holder in due course of a negotiable instrument are qualitatively, as matters of law, superior to those provided by ordinary species of contracts: A holder in due course is a person who receives or holds a negotiable instrument, such as a check or promissory note, in good faith and in exchange for value. Holder is a person who is entitled for the possession of a negotiable instrument in his own name. Bobby signs a promissory note to repay the $100,000. The holder is in a very important role as they are. Negotiated to the holder does not bear such apparent evidence of. What is an example of a holder in due course? A holder in due course refers to someone who receives a negotiable instrument, such as a check, promissory note, or bank draft, under specific conditions. The holder is referred to as the assignee. Hence he shall receive or recover the amount due thereon. Negotiated to the holder does not bear such apparent evidence of. A holder in due course is a person who receives or holds a negotiable instrument, such as a check or promissory note, in good faith and in exchange for value. A holder in due course refers to someone who receives a negotiable instrument, such as a check, promissory note, or bank draft, under specific conditions. The holder is referred to as the assignee. Holder is a person who is entitled for the possession of a negotiable instrument in his own name. A holder in due course is someone who has taken good faith possession of a negotiable instrument. The holder is in a very important role as they are. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any defects or claims. They are in possession of the assignor's rights and liabilities. According to section 9 of the negotiable instruments act, a holder in due course is someone who has obtained the instrument for value, in good faith, and without any notice of. A holder in due course is a person who receives or holds a negotiable instrument, such as a check or promissory note, in good faith and in exchange for value. This includes having it transferred to them, paying for it, and receiving it without knowing about. According to section 9 of the negotiable instruments act, a holder in due course. The rights of a holder in due course of a negotiable instrument are qualitatively, as matters of law, superior to those provided by ordinary species of contracts: The rule often referred to as the holder in due course rule is actually titled preservation of consumer claims and defenses. it is a rule issued by the federal trade commission and applies. A holder in due course is someone who has taken good faith possession of a negotiable instrument. Bank of america loan bobby $100,000 for a mortgage on a home; What is an example of a holder in due course? The rule often referred to as the holder in due course rule is actually titled preservation of consumer claims and defenses.. A holder in due course is a person who receives or holds a negotiable instrument, such as a check or promissory note, in good faith and in exchange for value. It refers to a person who has received a specific type of document, known as a 'negotiable instrument', in good faith. This means that the holder. Hence he shall receive. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; A holder in due course is a person who receives or holds a negotiable instrument, such as a check or promissory note, in good faith and in exchange for value.. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any defects or claims. It refers to a person who has received a specific type of document, known as a 'negotiable instrument', in good faith. This includes having it transferred to them, paying for it,. The holder in due course is often considered innocent of any claims. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; This includes having it transferred to them, paying for it, and receiving it without knowing about. They are. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; What is an example of a holder in due course? A 'holder in due course' is a term used in the world of finance and law. According to section 9. What is an example of a holder in due course? A holder in due course is a person who receives or holds a negotiable instrument, such as a check or promissory note, in good faith and in exchange for value. It refers to a person who has received a specific type of document, known as a 'negotiable instrument', in good. A 'holder in due course' is a term used in the world of finance and law. The holder is in a very important role as they are. The holder is referred to as the assignee. It refers to a person who has received a specific type of document, known as a 'negotiable instrument', in good faith. What is an example. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any defects or claims. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; What is an example of a holder in due course? This means that the holder. A holder in due course refers to someone who receives a negotiable instrument, such as a check, promissory note, or bank draft, under specific conditions. The rule often referred to as the holder in due course rule is actually titled preservation of consumer claims and defenses. it is a rule issued by the federal trade commission and applies to entities that sell and finance consumer goods. Negotiated to the holder does not bear such apparent evidence of. The rights of a holder in due course of a negotiable instrument are qualitatively, as matters of law, superior to those provided by ordinary species of contracts: A 'holder in due course' is a term used in the world of finance and law. Bobby signs a promissory note to repay the $100,000. Hence he shall receive or recover the amount due thereon. Bank of america loan bobby $100,000 for a mortgage on a home; According to section 9 of the negotiable instruments act, a holder in due course is someone who has obtained the instrument for value, in good faith, and without any notice of. A holder in due course is one possessing a check or promissory note, given in return for something of value, who has no knowledge of any defects or contradictory claims to its. A holder with such a preferred position can then treat the instrument. This includes having it transferred to them, paying for it, and receiving it without knowing about.Holder in Due Course

PPT Chapter 16 Negotiability, Transferability, and Liability

Holder & Holder In Due Course

Chapter 32 Negotiation and Holder in Due Course

PPT Holders in Due Course PowerPoint Presentation, free download ID

Holder & holder in due course PPT

TRANSFERABILITY AND HOLDER IN DUE COURSE ppt download

TRANSFERABILITY AND HOLDER IN DUE COURSE ppt download

PPT Chapter 16 Negotiability, Transferability, and Liability

Holder in Due Course and Defenses

Holder Is A Person Who Is Entitled For The Possession Of A Negotiable Instrument In His Own Name.

A Holder In Due Course Is A Person Who Receives Or Holds A Negotiable Instrument, Such As A Check Or Promissory Note, In Good Faith And In Exchange For Value.

A Holder In Due Course Is Someone Who Has Taken Good Faith Possession Of A Negotiable Instrument.

The Holder Is In A Very Important Role As They Are.

Related Post:

.jpg)