Enrolled Agent Cpe Courses

Enrolled Agent Cpe Courses - Premium live classeslive online instructionpass guarantee Whether you're aiming to enhance your insurance knowledge, navigate tap sales, elevate your sales and service skills or stay current on insurance trends,. After passing the see, you must maintain 72 hours of. Maintain your credential with becker’s ea continuing education subscription. Webce offers irs enrolled agent cpe courses. Check out the providers offering enrolled agents continuing education free of cost. Discover the ea syllabus with miles! Enrolled agents can get free ce credits by attending networking events and participating in online. This includes details about the exam, syllabi for each part,. Start your enrolled agent journey today! To become a illinois tax preparer or a illinois professional in preparation of income taxes, you need to attend our required enrolled agent cpe seminars or our enrolled agent cpe classes. Our enrolled agent all access offers a variety of benefits,. Get a detailed insight & comparison of top irs approved ea cpe course providers to choose the best platform for your continuing education & career advancement. The cost is just $99 for 12 months of unlimited. Yes, most enrolled agent cpe courses are available. Check out the providers offering enrolled agents continuing education free of cost. This includes details about the exam, syllabi for each part,. Maintain your credential with becker’s ea continuing education subscription. After passing the see, you must maintain 72 hours of. Attendance at forum seminars qualifies for ce credits for enrolled agents, certified public accountants, annual filing season program participants, california tax education. After passing the see, you must maintain 72 hours of. Enrolled agents can get free ce credits by attending networking events and participating in online. Attendance at forum seminars qualifies for ce credits for enrolled agents, certified public accountants, annual filing season program participants, california tax education. If you are a credentialed illinois cpa, enrolled agent, tax preparer, or other. The irs also publishes a free ea exam study materials for enrolled agent candidates. This includes details about the exam, syllabi for each part,. Enrolled agents can get free ce credits by attending networking events and participating in online. Our enrolled agent all access offers a variety of benefits,. Whether you're aiming to enhance your insurance knowledge, navigate tap sales,. To become a illinois tax preparer or a illinois professional in preparation of income taxes, you need to attend our required enrolled agent cpe seminars or our enrolled agent cpe classes. If you are a credentialed illinois cpa, enrolled agent, tax preparer, or other financial professional seeking ways to conveniently increase your practical knowledge while meeting cpe. Webce offers irs. The irs also publishes a free ea exam study materials for enrolled agent candidates. Our enrolled agent all access offers a variety of benefits,. Webce offers irs enrolled agent cpe courses. Enrolled agent ce course comparison wordpress data table plugin best enrolled agent ce providers. Maintain your credential with becker’s ea continuing education subscription. Discover the ea syllabus with miles! This includes details about the exam, syllabi for each part,. Get a detailed insight & comparison of top irs approved ea cpe course providers to choose the best platform for your continuing education & career advancement. Competitive pricingdownloadable contentcpe through podcasts Attendance at forum seminars qualifies for ce credits for enrolled agents, certified public. Discover the ea syllabus with miles! Cpe credits for cpascpe credits for easwebinars & seminarsunlimited cpe credits A comprehensive guide covering all exam sections and key topics to help you excel. Maintain your credential with becker’s ea continuing education subscription. Whether you're aiming to enhance your insurance knowledge, navigate tap sales, elevate your sales and service skills or stay current. Enrolled agents can get free ce credits by attending networking events and participating in online. Yes, most enrolled agent cpe courses are available. The irs also publishes a free ea exam study materials for enrolled agent candidates. Maintain your credential with becker’s ea continuing education subscription. Check out the providers offering enrolled agents continuing education free of cost. Whether you're aiming to enhance your insurance knowledge, navigate tap sales, elevate your sales and service skills or stay current on insurance trends,. Discover the ea syllabus with miles! Our enrolled agent all access offers a variety of benefits,. Start your enrolled agent journey today! The cost is just $99 for 12 months of unlimited. The cost is just $99 for 12 months of unlimited. Enrolled agent ce course comparison wordpress data table plugin best enrolled agent ce providers. Premium live classeslive online instructionpass guarantee The irs also publishes a free ea exam study materials for enrolled agent candidates. A comprehensive guide covering all exam sections and key topics to help you excel. Cpe credits for cpascpe credits for easwebinars & seminarsunlimited cpe credits The irs also publishes a free ea exam study materials for enrolled agent candidates. Many aspiring eas pursue formal education or specialized training programs to prepare for this challenging exam. Discover the ea syllabus with miles! A comprehensive guide covering all exam sections and key topics to help you. Attendance at forum seminars qualifies for ce credits for enrolled agents, certified public accountants, annual filing season program participants, california tax education. Webce offers irs enrolled agent cpe courses. Premium live classeslive online instructionpass guarantee Competitive pricingdownloadable contentcpe through podcasts Enrolled agents can get free ce credits by attending networking events and participating in online. The cost is just $99 for 12 months of unlimited. To become a illinois tax preparer or a illinois professional in preparation of income taxes, you need to attend our required enrolled agent cpe seminars or our enrolled agent cpe classes. If you are a credentialed illinois cpa, enrolled agent, tax preparer, or other financial professional seeking ways to conveniently increase your practical knowledge while meeting cpe. Start your enrolled agent journey today! A comprehensive guide covering all exam sections and key topics to help you excel. Get a detailed insight & comparison of top irs approved ea cpe course providers to choose the best platform for your continuing education & career advancement. The irs also publishes a free ea exam study materials for enrolled agent candidates. Check out the providers offering enrolled agents continuing education free of cost. Enrolled agent ce course comparison wordpress data table plugin best enrolled agent ce providers. After passing the see, you must maintain 72 hours of. Many aspiring eas pursue formal education or specialized training programs to prepare for this challenging exam.Enrolled Agent CPE Continuing Education Requirements

What to Look for in an Enrolled Agent Course

Best Enrolled Agent Continuing Education Courses

The CPE Requirements For Enrolled Agents 📈 Geneva Lunch

Enrolled Agent Exam Part 1 CRUSH The EA Exam 2022

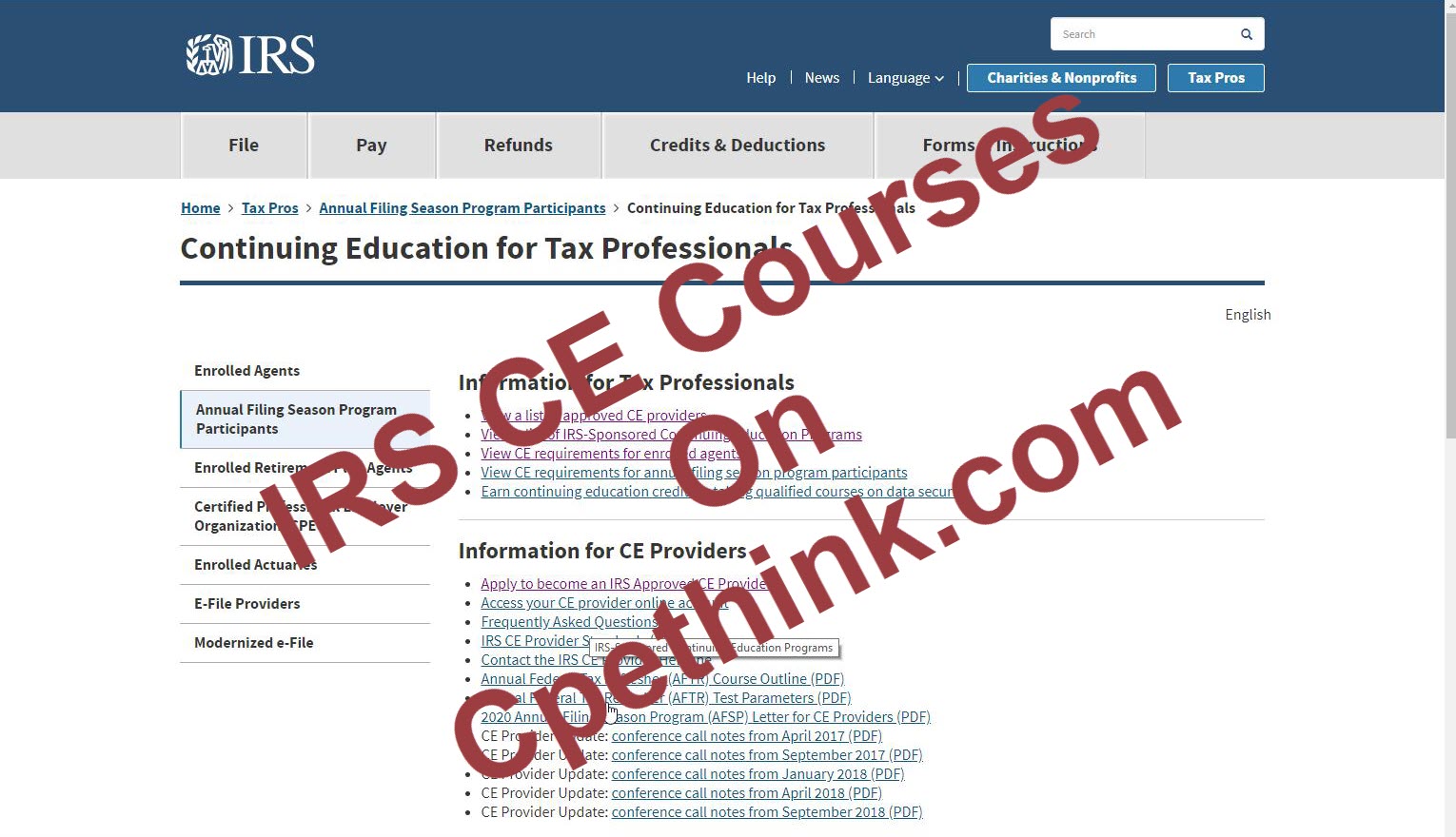

IRS and Enrolled Agent Continuing Education (CPE) Courses

Enrolled Agent (EA) the Complete Kaleidoscope Course, Eligibility

WHAT IF I MISSED ENROLLED AGENT CONTINUING EDUCATION REQUIREMENTS?

EA CPE Enrolled Agent CPE Courses EA CPE Credits WebCE

Web CPE NASBA approved CPE sponsor, CPE courses for CPAs and Enrolled

Our Enrolled Agent All Access Offers A Variety Of Benefits,.

Yes, Most Enrolled Agent Cpe Courses Are Available.

Cpe Credits For Cpascpe Credits For Easwebinars & Seminarsunlimited Cpe Credits

Whether You're Aiming To Enhance Your Insurance Knowledge, Navigate Tap Sales, Elevate Your Sales And Service Skills Or Stay Current On Insurance Trends,.

Related Post: