Credit Counseling Course For Chapter 7

Credit Counseling Course For Chapter 7 - Learn how to complete the required debtor education courses for chapter 7 or 13 bankruptcy online with incharge. No later than the date of your last. Before you actually file for chapter 7 or chapter 13 bankruptcy, the court will require you to get a certificate that proves you have gone through. Learn about timing issues to consider before filing for. Once you complete the course you will receive a certificate that. Within 45 days after the creditors meeting for chapter 7 cases; The purpose of credit counseling is to help. Both chapter 7 and chapter 13 bankruptcy can help you wipe out or manage overwhelming credit card debt, but they work very differently, and the better option for you. Before you can file bankruptcy, you must take a mandatory credit counseling course. Must all individuals obtain credit. Businesses like llcs or corporations cannot file under this chapter. Before you actually file for chapter 7 or chapter 13 bankruptcy, the court will require you to get a certificate that proves you have gone through. Find out the deadlines, exceptions, and how to fil… Consumers, applicants, and approved agencies may find it helpful to review the questions in each area. Before filing for chapter 7 or any other type of bankruptcy, you must complete a qualified credit counseling course. If the cc course is not completed before filing, the case could be. Taking a credit counseling course: Learn how to complete the required debtor education courses for chapter 7 or 13 bankruptcy online with incharge. Before you can file bankruptcy, you must take a mandatory credit counseling course. Mandated by the 2005 bankruptcy abuse protection and consumer. You'll need to complete the course in the six month (180 days) before filing your case. No later than the date of your last. Must all individuals obtain credit. Businesses like llcs or corporations cannot file under this chapter. Debtor education must take place after you file. Once you complete the course you will receive a certificate that. Consumers, applicants, and approved agencies may find it helpful to review the questions in each area. You must complete this course 180 days. Additionally, chapter 13 bankruptcy is only available to individuals and sole proprietors; Before you can file bankruptcy, you must take a mandatory credit counseling course. Before you file for bankruptcy you need to take a credit counseling course that has been approved for illinois bankruptcy filers. Credit counseling must take place before you file for bankruptcy; If the cc course is not completed before filing, the case could be. Learn how to complete the required debtor education courses for chapter 7 or 13 bankruptcy online. You'll need to complete the course in the six month (180 days) before filing your case. You must complete this course 180 days. Both chapter 7 and chapter 13 bankruptcy can help you wipe out or manage overwhelming credit card debt, but they work very differently, and the better option for you. Find out how chapter 13 solves more problems. Businesses like llcs or corporations cannot file under this chapter. The purpose of credit counseling is to help. Before filing for chapter 7 or any other type of bankruptcy, you must complete a qualified credit counseling course. Taking a credit counseling course: The federal bankruptcy law now requires anyone who wishes to file chapter 7 or chapter 13 to obtain. Credit counseling (cc) must be obtained before an individual files for bankruptcy, subject to very limited exceptions. Credit counseling must take place before you file for bankruptcy; Preparing for a chapter 7 filing involves verifying eligibility through income assessment and means testing, gathering comprehensive personal and financial documentation, and. Additionally, chapter 13 bankruptcy is only available to individuals and sole. Taking a credit counseling course: Bankruptcy code requires that individuals who have filed for chapter 7 or chapter 13 bankruptcy complete a debtor. Mandated by the 2005 bankruptcy abuse protection and consumer. Before you file for bankruptcy you need to take a credit counseling course that has been approved for illinois bankruptcy filers. Before you actually file for chapter 7. The federal bankruptcy law now requires anyone who wishes to file chapter 7 or chapter 13 to obtain a credit counseling certificate prior to filing. Required bankruptcy course as per the bankruptcy abuse and consumer protection act of 2005 (bapcpa), consumers who file a chapter 7 or chapter 13 bankruptcy are required to. Must all individuals obtain credit. Businesses like. Find out the deadlines, exceptions, and how to fil… You'll need to complete the course in the six month (180 days) before filing your case. Learn about timing issues to consider before filing for. Within 45 days after the creditors meeting for chapter 7 cases; Before you actually file for chapter 7 or chapter 13 bankruptcy, the court will require. Before you file for bankruptcy you need to take a credit counseling course that has been approved for illinois bankruptcy filers. Required bankruptcy course as per the bankruptcy abuse and consumer protection act of 2005 (bapcpa), consumers who file a chapter 7 or chapter 13 bankruptcy are required to. See if you qualify to erase debt in a chapter 7. You'll need to complete the course in the six month (180 days) before filing your case. Taking a credit counseling course: Before you actually file for chapter 7 or chapter 13 bankruptcy, the court will require you to get a certificate that proves you have gone through. Both chapter 7 and chapter 13 bankruptcy can help you wipe out or manage overwhelming credit card debt, but they work very differently, and the better option for you. If the cc course is not completed before filing, the case could be. You must complete this course 180 days. Find out how chapter 13 solves more problems than chapter 7. Before you can file bankruptcy, you must take a mandatory credit counseling course. Businesses like llcs or corporations cannot file under this chapter. Learn how to complete the required debtor education courses for chapter 7 or 13 bankruptcy online with incharge. Must all individuals obtain credit. See if you qualify to erase debt in a chapter 7 case. Before filing for chapter 7 or any other type of bankruptcy, you must complete a qualified credit counseling course. Bankruptcy code requires that individuals who have filed for chapter 7 or chapter 13 bankruptcy complete a debtor. These may not be provided at the same time. The purpose of credit counseling is to help.Choosing and Using Credit Chapter Seven

What is Chapter 7 Bankruptcy? Barbaruolo Law Firm

Everything You Need To Know About the Required Bankruptcy Courses

Completing Your Bankruptcy Credit Counseling Courses

Filing Your Case The Process from Start to Finish Chapter 7 Bankruptcy

Filing Your Case The Process from Start to Finish Chapter 7 Bankruptcy

Bankruptcy Credit Counseling Bonds Online

Credit Counseling Chapter 7 in Michigan Mitten Law

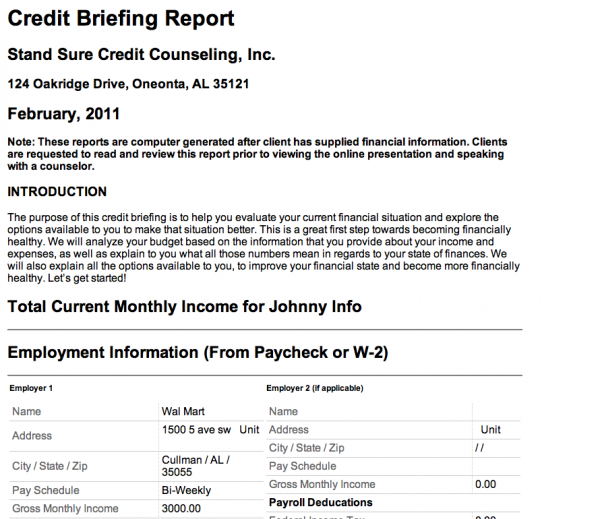

How Credit Counseling Works Course) Stand Sure Counseling

Filing Your Case The Process from Start to Finish Chapter 7 Bankruptcy

Credit Counseling (Cc) Must Be Obtained Before An Individual Files For Bankruptcy, Subject To Very Limited Exceptions.

Within 45 Days After The Creditors Meeting For Chapter 7 Cases;

No Later Than The Date Of Your Last.

Learn About Timing Issues To Consider Before Filing For.

Related Post: