Cpa Course Near Me

Cpa Course Near Me - This exam consists of 4. Find cpa exam requirements and qualifications, fees, if 150 credit hours required, fulfilling the education/class requirements, licensing, ethics, residency, citizenship, and age. If you are planning to become a certified public accountant, illinois is a great choice. Resume your testing, verify your credentials and more. Over 200 programsrequest informationideal for adult studentspublic & nonprofit Why it’s critical to understand cpa exam requirements early. To become a cpa in illinois, you’ll need to meet all of the illinois cpa requirements. You will also have to take the right courses, pay some fees, and get the right work experience. The depaul curriculum fully prepares you for the content that is tested on the cpa exam. Illinois cpa exam & license requirements 2025. There are six main steps to complete in order to earn a cpa license in the state. Why it’s critical to understand cpa exam requirements early. Learn 100% onlineaccredited collegesconvenient start dates Here are some review course options intended as informational material to help you begin to explore the options. You will also have to take the right courses, pay some fees, and get the right work experience. The uniform cpa examination isn’t just a test — it’s part of a professional licensure process. The uniform certified public accountant (cpa) exam is one of the barriers you must cross to become a. The uniform cpa exam is the examination administered to people who wish to become u.s. Over 200 programsrequest informationideal for adult studentspublic & nonprofit Learn about the cpa requirements and the approval process. Before you’re even allowed to. Get the confidence you need to succeed. You will also have to take the right courses, pay some fees, and get the right work experience. Now that you know if you qualify to sit for the cpa exam, it’s time to choose cpa prep that’s right for you. Resume your testing, verify your credentials and. Interested in taking the cpa exam? Pass the cpa test with varsity tutors chicago, il cpa courses. Get the confidence you need to succeed. Excellent student supportstrengthen your faithnonprofit university Learn about testing and the certification process. Before you’re even allowed to. Find cpa exam requirements and qualifications, fees, if 150 credit hours required, fulfilling the education/class requirements, licensing, ethics, residency, citizenship, and age. Varsity tutors makes it easier to put together your chicago cpa exam prep strategy. Visit prometric.com to find a cpa test center in illinois near you. Learn 100% onlineaccredited collegesconvenient start dates It includes 30 hours of accounting, 24 hours. Ohio's state governor signed house bill 238 into law on jan. Affordable tuition rateshigh demand specialtiescommitment to excellence Capella’s delta mu deltaacbsp accreditedcredit for certificationsdistinguished faculty Get the confidence you need to succeed. Here are some review course options intended as informational material to help you begin to explore the options. The following sections provide you with information on cpa eligibility, preparation and the. Excellent student supportstrengthen your faithnonprofit university Learn about the cpa requirements and the approval process. Before you’re even allowed to. Over 200 programsrequest informationideal for adult studentspublic & nonprofit You will also have to take the right courses, pay some fees, and get the right work experience. If you are planning to become a certified public accountant, illinois is a great choice. Now that you know if you qualify to sit for the cpa exam, it’s time to choose cpa. Now that you know if you qualify to sit for the cpa exam, it’s time to choose cpa prep that’s right for you. Achieving cpa licensure in illinois involves meeting specific educational requirements, passing the cpa exam, gaining relevant work experience, and adhering to. It includes 30 hours of accounting, 24 hours. The uic bachelor of science in accounting program. It includes 30 hours of accounting, 24 hours. Achieving cpa licensure in illinois involves meeting specific educational requirements, passing the cpa exam, gaining relevant work experience, and adhering to. Varsity tutors makes it easier to put together your chicago cpa exam prep strategy. Learn about the cpa requirements and the approval process. The uic bachelor of science in accounting program. 1, 2026, two additional pathways to cpa licensure will be available:. To become a cpa in illinois, you’ll need to meet all of the illinois cpa requirements. Varsity tutors makes it easier to put together your chicago cpa exam prep strategy. The uniform certified public accountant (cpa) exam is one of the barriers you must cross to become a. The. It includes 30 hours of accounting, 24 hours. You will also have to take the right courses, pay some fees, and get the right work experience. Varsity tutors makes it easier to put together your chicago cpa exam prep strategy. Over 200 programsrequest informationideal for adult studentspublic & nonprofit The uniform cpa exam is the examination administered to people who. The following sections provide you with information on cpa eligibility, preparation and the. Resume your testing, verify your credentials and more. The uic bachelor of science in accounting program satisfies all the educational course requirements for taking the cpa exam in illinois. Affordable tuition rateshigh demand specialtiescommitment to excellence Now that you know if you qualify to sit for the cpa exam, it’s time to choose cpa prep that’s right for you. Varsity tutors makes it easier to put together your chicago cpa exam prep strategy. Learn about testing and the certification process. Why it’s critical to understand cpa exam requirements early. To become a cpa in illinois, you’ll need to meet all of the illinois cpa requirements. There are six main steps to complete in order to earn a cpa license in the state. Achieving cpa licensure in illinois involves meeting specific educational requirements, passing the cpa exam, gaining relevant work experience, and adhering to. The uniform cpa examination isn’t just a test — it’s part of a professional licensure process. Over 200 programsrequest informationideal for adult studentspublic & nonprofit Capella’s delta mu deltaacbsp accreditedcredit for certificationsdistinguished faculty It includes 30 hours of accounting, 24 hours. Ohio's state governor signed house bill 238 into law on jan.CPA Near Me YouTube

Top CPA Accounting Firm in Venice, FL Local Certified Public

Top Services Provided by a CPA Near Me in Fort Collins Colorado

CPA USA Course details, Eligibility, Benefits and Fee structure

Best US CPA Training Institute India Course Eligibility, Duration

Simons Associates Kottayam, simons academy kottayam, simonsassociates

Why CA Must Do CPA Course? AK's Training Academy

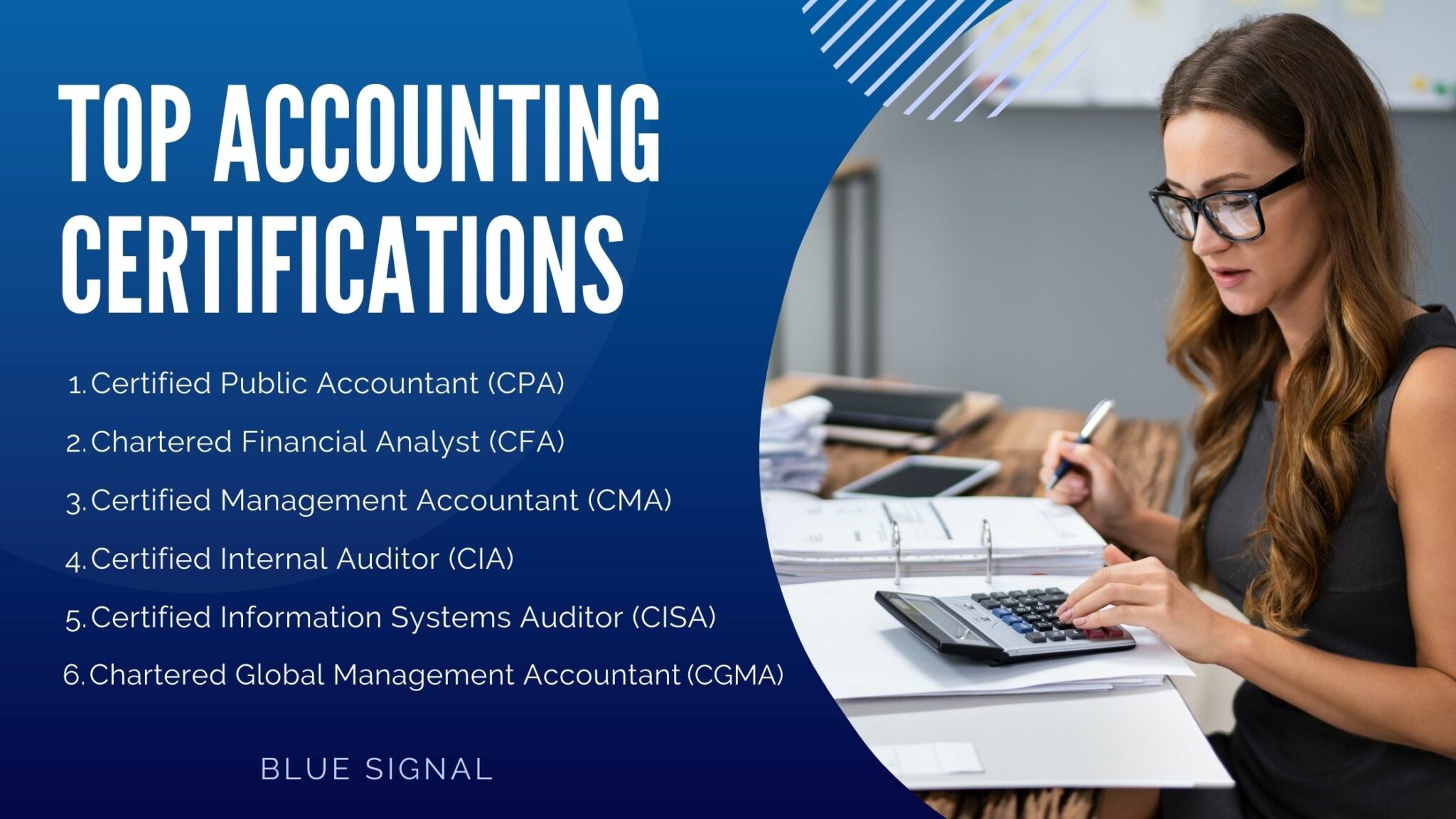

Accounting Certifications to Advance Your Career Blue Signal Search

Enhance Your Skill With Finance & Accounting Training Course Promise

Accounting Training Courses etaxaccountants

What Is The Uniform Cpa Exam?

Excellent Student Supportstrengthen Your Faithnonprofit University

1, 2026, Two Additional Pathways To Cpa Licensure Will Be Available:.

Find Cpa Exam Requirements And Qualifications, Fees, If 150 Credit Hours Required, Fulfilling The Education/Class Requirements, Licensing, Ethics, Residency, Citizenship, And Age.

Related Post: