Cic Course Schedule

Cic Course Schedule - Those working toward their designations test online the following week. Each cic institute is 16 hours of instruction, followed by an optional exam. Check out the calendar below for course schedule and details. Enhance your career with our comprehensive courses. No test is required for ce or your designation update. Cic classes are offered in conjunction with the massachusetts association of insurance agents. To earn the cic designation, you must complete five of the seven cic course offerings. Participants can earn easy ce hours while learning valuable information to grow technical skills and. Personal lines, life & health;. To obtain your cic designation, you must complete and pass any five examinations within 5 years of passing your first cic exam. Those working toward their designations test online the following week. There you can filter by category and indicate cic to see the upcoming courses. To register for a cic course, please navigate to our education calendar. Cic classes are offered in conjunction with the massachusetts association of insurance agents. Our practical risk management and insurance courses are taught by active insurance practitioners, include policies and forms currently used in the field, and guide you through real. You have five calendar years from the date of your first passed exam to complete the process. To earn the cic designation, individuals must complete five intensive courses—each followed by a comprehensive exam—covering key areas such as commercial property, commercial. Each cic institute is 16 hours of instruction, followed by an optional exam. Current, practical course content, applicable to your everyday work. Check out the calendar below for course schedule and details. Registration and calendar dates will be scheduled through maia's office. Current, practical course content, applicable to your everyday work. The coveted certified insurance counselor (cic) designation signifies a higher professional level of experience and. Enhance your career with our comprehensive courses. Our practical risk management and insurance courses are taught by active insurance practitioners, include policies and forms currently used. Each cic institute is 16 hours of instruction, followed by an optional exam. Registration and calendar dates will be scheduled through maia's office. Cic classes are offered in conjunction with the massachusetts association of insurance agents. Current, practical course content, applicable to your everyday work. To register for a cic course, please navigate to our education calendar. To earn the cic designation, individuals must complete five intensive courses—each followed by a comprehensive exam—covering key areas such as commercial property, commercial. Those working toward their designations test online the following week. The coveted certified insurance counselor (cic) designation signifies a higher professional level of experience and. Current, practical course content, applicable to your everyday work. To obtain your. The coveted certified insurance counselor (cic) designation signifies a higher professional level of experience and. Our practical risk management and insurance courses are taught by active insurance practitioners, include policies and forms currently used in the field, and guide you through real. To obtain your cic designation, you must complete and pass any five examinations within 5 years of passing. The coveted certified insurance counselor (cic) designation signifies a higher professional level of experience and. Participants can earn easy ce hours while learning valuable information to grow technical skills and. To obtain your cic designation, you must complete and pass any five examinations within 5 years of passing your first cic exam. Current, practical course content, applicable to your everyday. You have five calendar years from the date of your first passed exam to complete the process. Those working toward their designations test online the following week. Participants can earn easy ce hours while learning valuable information to grow technical skills and. The coveted certified insurance counselor (cic) designation signifies a higher professional level of experience and. To register for. Check out the calendar below for course schedule and details. Each cic institute is 16 hours of instruction, followed by an optional exam. The coveted certified insurance counselor (cic) designation signifies a higher professional level of experience and. No test is required for ce or your designation update. To earn the cic designation, you must complete five of the seven. Registration and calendar dates will be scheduled through maia's office. Enhance your career with our comprehensive courses. No test is required for ce or your designation update. Current, practical course content, applicable to your everyday work. The coveted certified insurance counselor (cic) designation signifies a higher professional level of experience and. Registration and calendar dates will be scheduled through maia's office. Enhance your career with our comprehensive courses. Current, practical course content, applicable to your everyday work. You have five calendar years from the date of your first passed exam to complete the process. Participants can earn easy ce hours while learning valuable information to grow technical skills and. Each cic institute is 16 hours of instruction, followed by an optional exam. Customize your education and choose five of the following options to earn your cic designation. Participants can earn easy ce hours while learning valuable information to grow technical skills and. Check out the calendar below for course schedule and details. The coveted certified insurance counselor (cic) designation. Our practical risk management and insurance courses are taught by active insurance practitioners, include policies and forms currently used in the field, and guide you through real. To earn the cic designation, you must complete five of the seven cic course offerings. Registration and calendar dates will be scheduled through maia's office. Personal lines, life & health;. Current, practical course content, applicable to your everyday work. Enhance your career with our comprehensive courses. Customize your education and choose five of the following options to earn your cic designation. No test is required for ce or your designation update. The coveted certified insurance counselor (cic) designation signifies a higher professional level of experience and. Check out the calendar below for course schedule and details. The coveted certified insurance counselor (cic) designation signifies a higher professional level of experience and. Participants can earn easy ce hours while learning valuable information to grow technical skills and. To register for a cic course, please navigate to our education calendar. Current, practical course content, applicable to your everyday work. To obtain your cic designation, you must complete and pass any five examinations within 5 years of passing your first cic exam. These courses cover more than forty essential topics—personal lines, commercial lines, life and health, and risk management, plus specialty topics, such as insuring “toys” and.CIC_CourseStructure PDF Free Download

CIC Certified Insurance Counselor The National Alliance for

NEW CIC SelfPaced Course Commercial Multiline

Academics CIC & International Partnerships College of Intercultural

It's Never Too Early To Be Planning for 2023

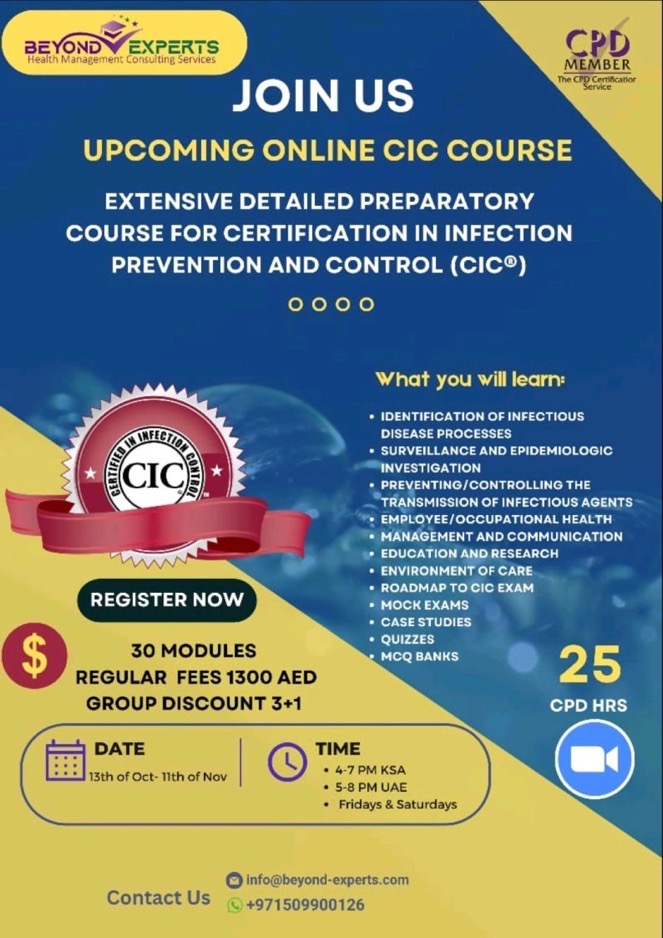

Extensive Detailed Course for Certification in Infection Prevention and

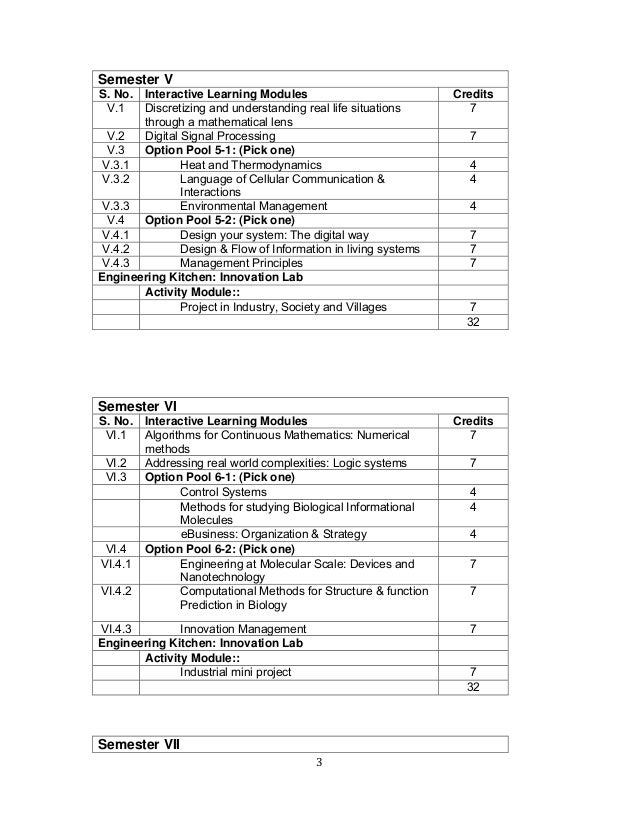

CIC_Course_Structure

Comprehensive Infection Control CIC Preparatory Course Beyond Experts

CIC Professional Insurance Agents of VA and DC

CIC Course Trusted Wealth Professionals Trusted Wealth Professionals

Cic Classes Are Offered In Conjunction With The Massachusetts Association Of Insurance Agents.

Those Working Toward Their Designations Test Online The Following Week.

You Have Five Calendar Years From The Date Of Your First Passed Exam To Complete The Process.

To Earn The Cic Designation, Individuals Must Complete Five Intensive Courses—Each Followed By A Comprehensive Exam—Covering Key Areas Such As Commercial Property, Commercial.

Related Post: