Chapter 7 Bankruptcy Credit Counseling Course

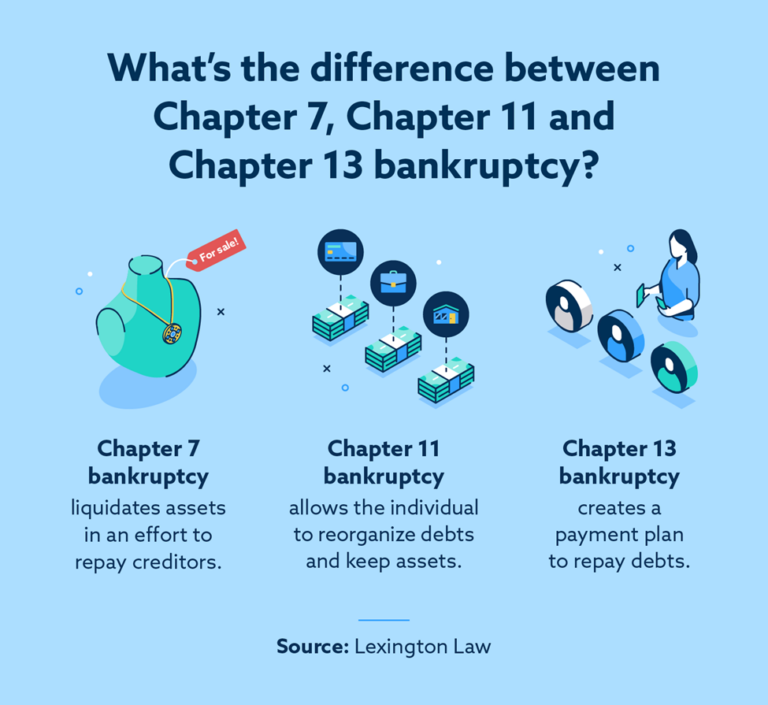

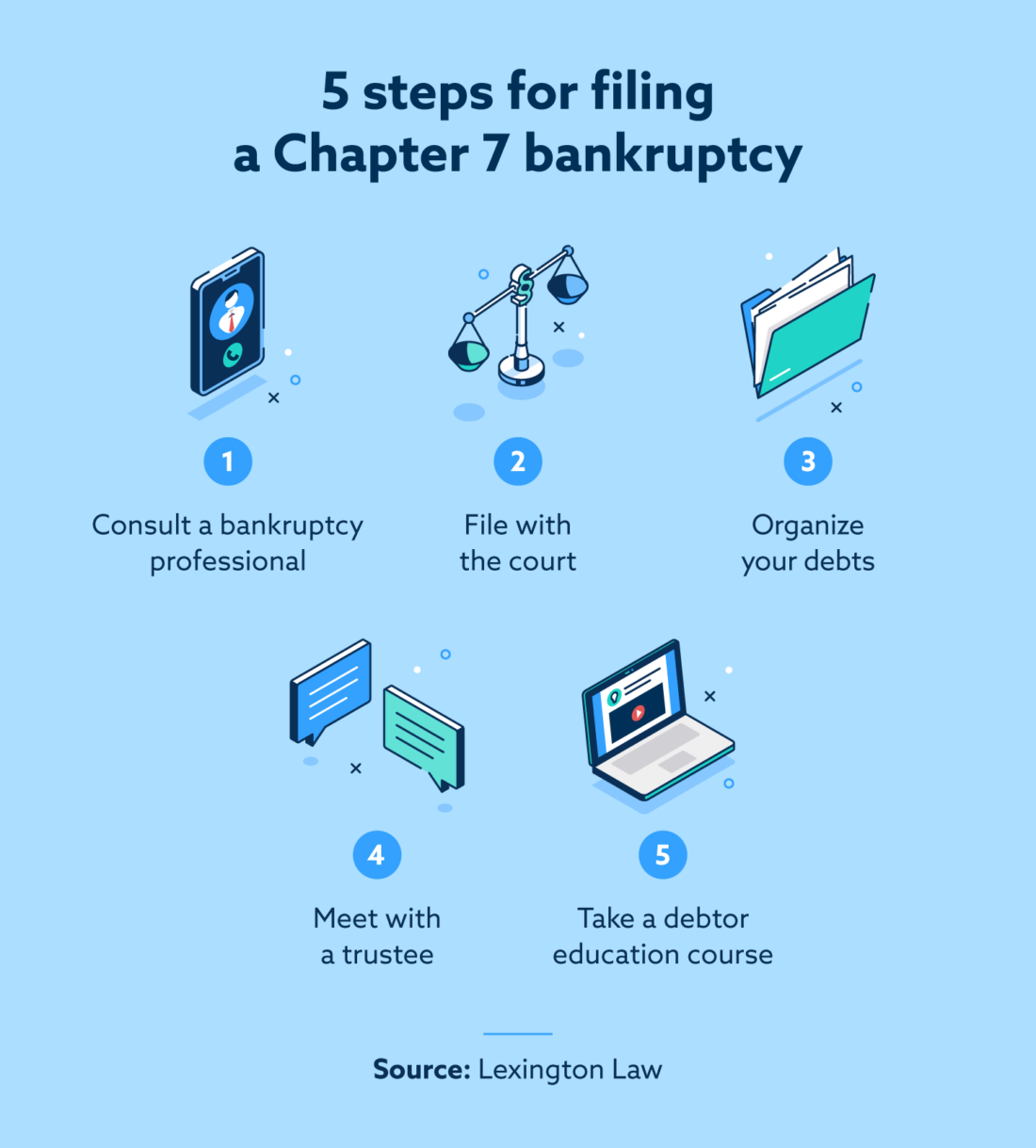

Chapter 7 Bankruptcy Credit Counseling Course - This is the first bankruptcy course that must be completed prior to filing for bankruptcy in illinois. Required bankruptcy course as per the bankruptcy abuse and consumer protection act of 2005 (bapcpa), consumers who file a chapter 7 or chapter 13 bankruptcy are required to. Mandated by the 2005 bankruptcy abuse protection and consumer. Before you can file bankruptcy, you must take a mandatory credit counseling. Credit counseling and debtor education requirements in bankruptcy. If the cc course is not completed before filing, the case could be. What if my bankruptcy credit counseling waiver is denied? This has to be completed between the start of the bankruptcy process and before the final judgment is announced. Adhering strictly to the course requirements and completion criteria is vital for a smooth and compliant chapter 7 bankruptcy process. These may not be provided at the same time. These may not be provided at the same time. The federal bankruptcy law now requires anyone who wishes to file chapter 7 or chapter 13 to obtain a credit counseling certificate prior to filing. While you need to complete the credit counseling course before your initial filing, you do not need to take the debtor education course until after you file for bankruptcy. The purpose of credit counseling is to help. Credit counseling (cc) must be obtained before an individual files for bankruptcy, subject to very limited exceptions. Free consultationfree consultationstop 5 rated firmshighest ethical standards After you file bankruptcy, you are required to take a debtor education class. † includes 24/7 access to the counseling in motion online course. Before you can file bankruptcy, you must take a mandatory credit counseling. Debtor education must take place after you file. Debtor education must take place after you file. If the cc course is not completed before filing, the case could be. † includes 24/7 access to the counseling in motion online course. This has to be completed between the start of the bankruptcy process and before the final judgment is announced. Almost all individuals who file for bankruptcy must take. Debtor education must take place after you file. Must all individuals obtain credit. Once you complete the course you will receive. Need help filing chapter 7? Credit counseling (cc) must be obtained before an individual files for bankruptcy, subject to very limited exceptions. Before you can file bankruptcy, you must take a mandatory credit counseling. Required bankruptcy course as per the bankruptcy abuse and consumer protection act of 2005 (bapcpa), consumers who file a chapter 7 or chapter 13 bankruptcy are required to. † includes 24/7 access to the counseling in motion online course. The purpose of this course is to help a. Credit counseling (cc) must be obtained before an individual files for bankruptcy, subject to very limited exceptions. If the cc course is not completed before filing, the case could be. Bankruptcy code, all debtors throughout the united states filing for personal bankruptcy protection, whether it be a chapter 7 or chapter 13, must complete a credit. Mandated by the 2005. Receive your certificate immediately after completing the course. Debtor education course is a mandatory requirement for chapter 7 or chapter 13 bankruptcy. Once you complete the course you will receive. These may not be provided at the same time. The purpose of credit counseling is to help. Required bankruptcy course as per the bankruptcy abuse and consumer protection act of 2005 (bapcpa), consumers who file a chapter 7 or chapter 13 bankruptcy are required to. Free consultationfree consultationstop 5 rated firmshighest ethical standards Receive your certificate immediately after completing the course. Required by law before you can file for bankruptcy. These may not be provided at the. Debtor education course is a mandatory requirement for chapter 7 or chapter 13 bankruptcy. Must all individuals obtain credit. Adhering strictly to the course requirements and completion criteria is vital for a smooth and compliant chapter 7 bankruptcy process. Credit counseling and debtor education requirements in bankruptcy. All the courses mandated, debtor education or credit counseling, it has to be. Need help filing chapter 7? Required bankruptcy course as per the bankruptcy abuse and consumer protection act of 2005 (bapcpa), consumers who file a chapter 7 or chapter 13 bankruptcy are required to. Must all individuals obtain credit. Receive your certificate immediately after completing the course. Before you can file for chapter 7 or chapter 13 bankruptcy, you must take. Required by law before you can file for bankruptcy. All the courses mandated, debtor education or credit counseling, it has to be pursued through a federally recognized agency. Before you can file for chapter 7 or chapter 13 bankruptcy, you must take a course from a nonprofit credit counseling agency to determine whether you can handle your debt load. Before. Credit counseling must take place before you file for bankruptcy; This is the first bankruptcy course that must be completed prior to filing for bankruptcy in illinois. Debtor education must take place after you file. Free consultationfree consultationstop 5 rated firmshighest ethical standards Almost all individuals who file for bankruptcy must take two mandatory bankruptcy education courses. These may not be provided at the same time. Credit counseling (cc) must be obtained before an individual files for bankruptcy, subject to very limited exceptions. Bankruptcy code, all debtors throughout the united states filing for personal bankruptcy protection, whether it be a chapter 7 or chapter 13, must complete a credit. The purpose of credit counseling is to help. This has to be completed between the start of the bankruptcy process and before the final judgment is announced. This class is necessary to receive a discharge of your debts. All the courses mandated, debtor education or credit counseling, it has to be pursued through a federally recognized agency. Debtor education must take place after you file. Receive your certificate immediately after completing the course. The federal bankruptcy law now requires anyone who wishes to file chapter 7 or chapter 13 to obtain a credit counseling certificate prior to filing. Need help filing chapter 7? † includes 24/7 access to the counseling in motion online course. Before you can file for chapter 7 or chapter 13 bankruptcy, you must take a course from a nonprofit credit counseling agency to determine whether you can handle your debt load. While you need to complete the credit counseling course before your initial filing, you do not need to take the debtor education course until after you file for bankruptcy. Adhering strictly to the course requirements and completion criteria is vital for a smooth and compliant chapter 7 bankruptcy process. Free consultationfree consultationstop 5 rated firmshighest ethical standardsWhat Is Chapter 7 Bankruptcy? A Liquidation Guide Lexington Law

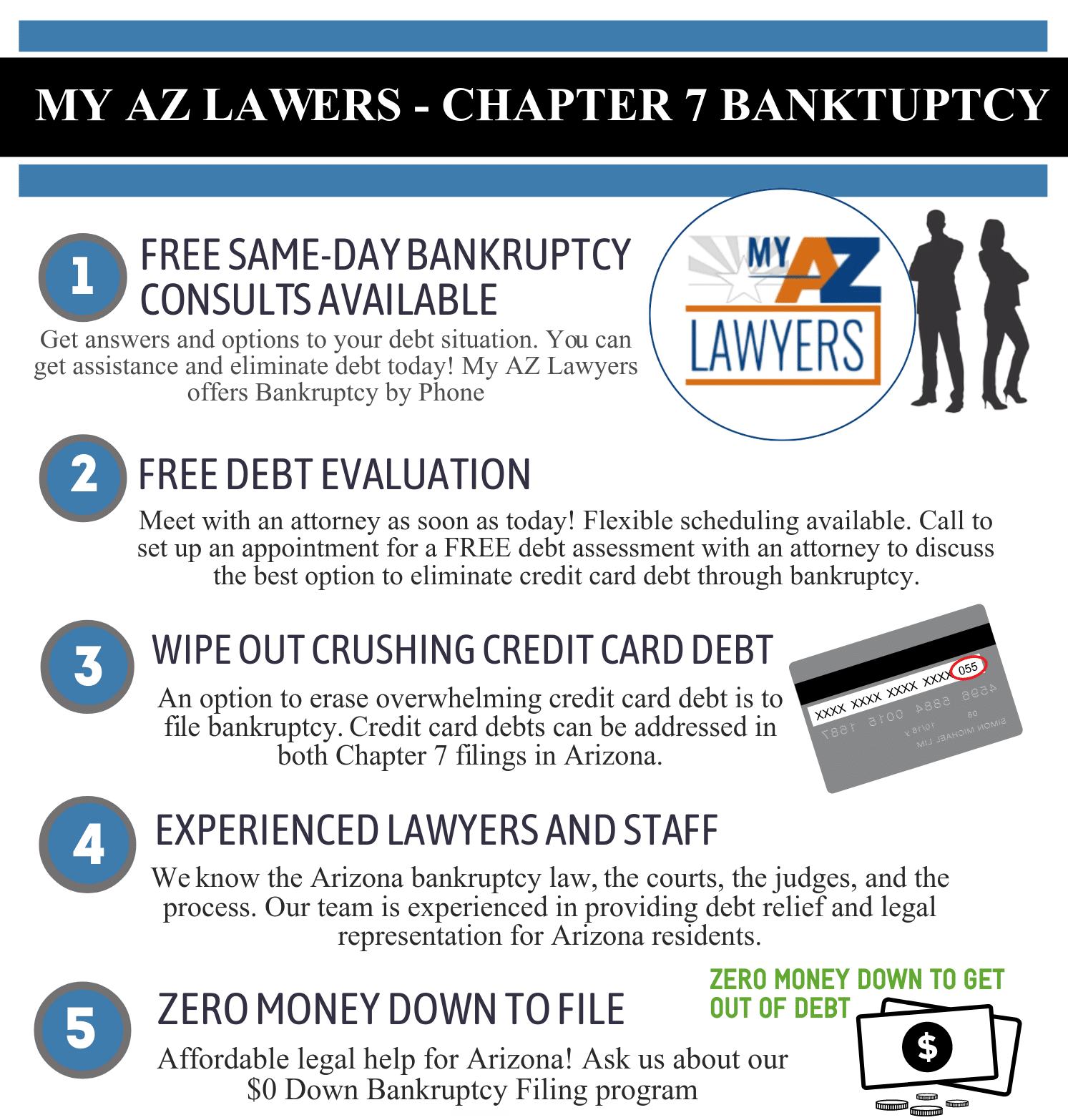

Arizona Chapter 7 Bankruptcy Bankruptcy Attorneys in AZ for Ch. 7 BK

Everything You Need To Know About the Required Bankruptcy Courses

What Is Chapter 7 Bankruptcy? Definition, Pros & Cons TheStreet

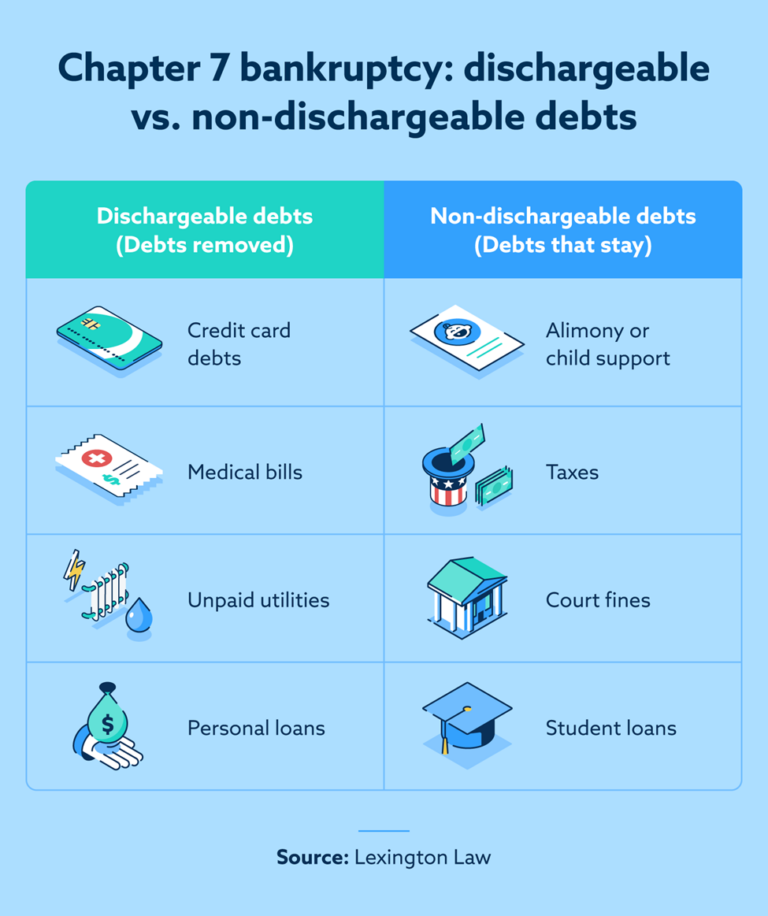

What Is Chapter 7 Bankruptcy? A Liquidation Guide Lexington Law

What Is Chapter 7 Bankruptcy? Experian

What Is Chapter 7 Bankruptcy? A Liquidation Guide Lexington Law

Arizona Chapter 7 Bankruptcy Bankruptcy Attorneys in AZ for Ch. 7 BK

What Is Chapter 7 Bankruptcy? A Liquidation Guide Lexington Law

Filing Your Case The Process from Start to Finish Chapter 7 Bankruptcy

Debtor Education Course Is A Mandatory Requirement For Chapter 7 Or Chapter 13 Bankruptcy.

Credit Counseling Must Take Place Before You File For Bankruptcy;

This Is The First Bankruptcy Course That Must Be Completed Prior To Filing For Bankruptcy In Illinois.

Mandated By The 2005 Bankruptcy Abuse Protection And Consumer.

Related Post: